The Biden administration says Medicare recipients will save about $1.5 billion on out-of-pocket costs for medications to treat diabetes, heart disease, types of arthritis and other ailments under new prices negotiated with drug companies that will take effect in 2026.

The savings range from 79% for Januvia, used to manage diabetes, to 38% for Imbruvica, which is used to treat blood cancers. That is the medication’s cost before any discounts or rebates are applied, but not what the price people actually pay when filling their prescriptions.

A look at the drugs and the negotiated prices.

Manufacturer: Merck Sharp Dohme

Conditions: Diabetes

Negotiated price: $113 for a 30-day supply

Reduction: 79%

Manufacturer: Novo Norodisk

Conditions: Diabetes

Negotiated price: $119 for a 30- day supply

Reduction: 76%

Manufacturer: AstraZeneca AB.

Conditions: Diabetes, heart failure and chronic kidney disease

Negotiated price: $178.50 for a 30-day supply

Reduction: 68%

Manufacturer: Immunex Corp.

Conditions: Rheumatoid arthritis, psoriasis and psoriatic arthritis

Negotiated price: $2,355 for a 30-day supply

Reduction: 67%

Manufacturer: Boehringer Ingelheim

Conditions: Diabetes, heart failure and chronic kidney disease

Negotiated price: $197 for a 30-day supply

Reduction: 66%

Manufacturer: Janssen Biotech Inc.

Conditions: Psoriasis, psoriatic arthritis, Crohn’s disease, ulcerative colitis

Negotiated price: $4,695 for a 30-day supply

Reduction: 66%

Manufacturer: Janssen Pharms

Conditions: Prevention and treatment of blood clots. Reduction of risk for patients with coronary or peripheral artery disease

Negotiated price: $197 for a 30-day supply

Reduction: 62%

Manufacturer: Bristol Myers Squibb

Conditions: Prevention and treatment of blood clots

Negotiated price: $231 for a 30-day supply

Reduction: 56%

Manufacturer: Novartis Pharms Corp

Conditions: Heart failure

Negotiated price: $295 for a 30-day supply

Reduction: 53%

Manufacturer: Pharmacyclics LLC

Conditions: Blood cancers

Negotiated price: $9,319 for a 30-day supply

Savings: 38%

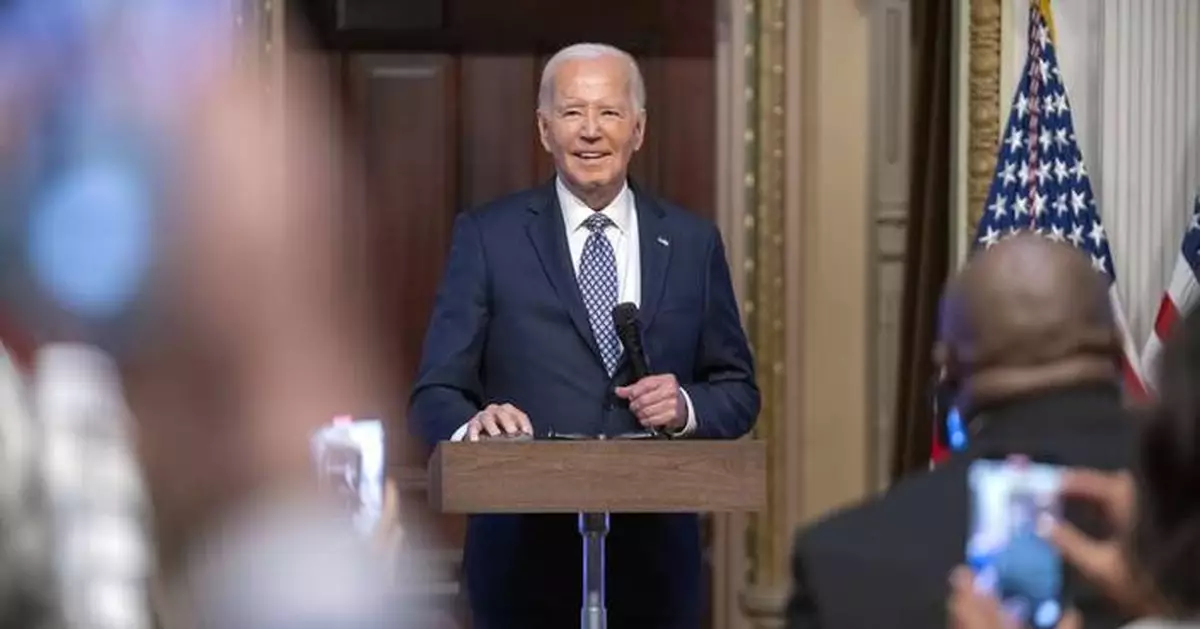

President Joe Biden speaks about the administration's efforts to lower prescription drug costs during an event at Prince George's Community College in Largo, Md., Thursday, Aug. 15, 2024. (AP Photo/Susan Walsh)

President Joe Biden speaks at the White House Creator Economy Conference in the Indian Treaty Room at the Eisenhower Executive Office Building on the White House complex, Wednesday, Aug. 14, 2024, in Washington. (AP Photo/Mark Schiefelbein)

WASHINGTON (AP) — The price of bitcoin surged to over $109,000 early Monday, just hours ahead of President-elect Donald Trump’s inauguration, as a pumped up cryptocurrency industry bets he'll take action soon after returning to the White House.

Once a skeptic who said a few years ago that bitcoin “ seems like a scam,” Trump has embraced digital currencies with a convert’s zeal. He's launched a new cryptocurrency venture and vowed on the campaign trail to take steps early in his presidency to make the U.S. into the “crypto capital” of the world.

His promises including creating a U.S. crypto stockpile, enacting industry-friendly regulation and event appointing a crypto “czar” for his administration.

“You’re going to be very happy with me,” Trump told crypto-enthusiasts at a bitcoin conference last summer.

Bitcoin is the world’s most popular cryptocurrency and was created in 2009 as a kind of electronic cash uncontrolled by banks or governments. It and newer forms of cryptocurrencies have moved from the financial fringes to the mainstream in wild fits and starts.

The highly volatile nature of cryptocurrencies as well as their use by criminals, scammers and rogue nations, has attracted plenty of critics, who say the digital currencies have limited utility and often are just Ponzi schemes.

But crypto has so far defied naysayers and survived multiple prolonged price drops in its short lifespan. Wealthy players in the crypto industry, which felt unfairly targeted by the Biden administration, spent heavily to help Trump win November’s election. Bitcoin has surged in price since Trump's victory, topping $100,000 for the first time last month before briefly sliding down to about $90,000. On Friday, it rose about 5%. It jumped more than $9,000 early Monday, according to CoinDesk.

Two years ago, bitcoin was trading at about $20,000.

Trump’s picks for key cabinet and regulatory positions are stocked with crypto supporters, including his choice to lead the Treasury and Commerce departments and the head of the Securities and Exchange Commission.

Key industry players held a first ever "Crypto Ball” on Friday to celebrate the first “crypto president." The event was sold out, with tickets costing several thousand dollars.

Here’s a look at some detailed action Trump might take in the early days of his administration:

As a candidate Trump promised that he would create a special advisory council to provide guidance on creating “clear” and “straightforward” regulations on crypto within the first 100 days of his presidency.

Details about the council and its membership are still unclear, but after winning November’s election, Trump named tech executive and venture capitalist David Sacks to be the administration’s crypto “czar.” Trump also announced in late December that former North Carolina congressional candidate Bo Hines will be the executive director of the “Presidential Council of Advisers for Digital Assets.”

At last year’s bitcoin conference, Trump told crypto supporters that new regulations “will be written by people who love your industry, not hate your industry.” Trump's pick to lead the SEC, Paul Atkins, has been a strong advocate for cryptocurrencies.

Crypto investors and companies chafed as what they said was a hostile Biden administration that went overboard in unfair enforcement actions and accounting policies that have stifled innovation in the industry — particularly at the hands of outgoing SEC Chairman Gary Gensler.

“As far as general expectations from the Trump Administration, I think one of the best things to bet on is a tone change at the SEC,” said Peter Van Valkenburgh, the executive director of the advocacy group Coin Center.

Gensler, who is set to leave as Trump takes office, said in a recent interview with Bloomberg that he’s proud of his office’s actions to police the crypto industry, which he said is “rife with bad actors.”

Trump also promised that as president he’ll ensure the U.S. government stockpiles bitcoin, much like it already does with gold. At the bitcoin conference earlier this summer, Trump said it the U.S. government would keep, rather than auction off, the billions of dollars in bitcoin it has seized through law enforcement actions.

Crypto advocates have posted a draft executive order online that would establish a “Strategic Bitcoin Reserve” as a “permanent national asset” to be administered by the Treasury Department through its Exchange Stabilization Fund. The draft order calls for the Treasury Department to eventually hold at least $21 billion in bitcoin.

Republican Sen. Cynthia Lummis of Wyoming has proposed legislation mandating the U.S. government stockpile bitcoin, which advocates said would help diversify government holdings and hedge against financial risks. Critics say bitcoin’s volatility make it a poor choice as a reserve asset.

Creating such a stockpile would also be a “giant step in the direction of bitcoin becoming normalized, becoming legitimatized in the eyes of people who don’t yet see it as legitimate,” said Zack Shapiro, an attorney who is head of policy at the Bitcoin Policy Institute.

At the bitcoin conference earlier this year, Trump received loud cheers when he reiterated a promise to commute the life sentence of Ross Ulbricht, the convicted founder of the drug-selling website Silk Road that used crypto for payments.

Ulbricht’s case has energized some crypto advocates and Libertarian activists, who believe government investigators overreached in building their case against Silk Road.

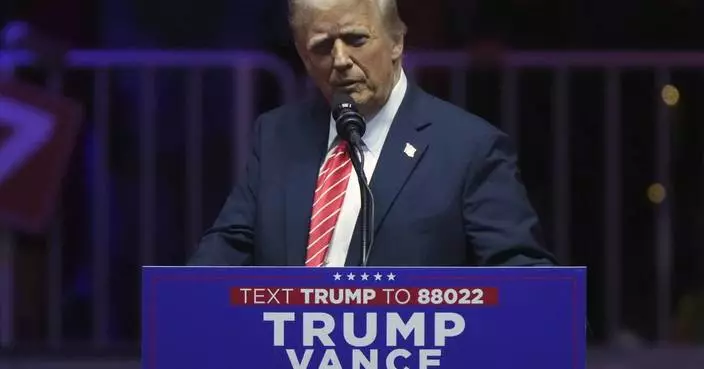

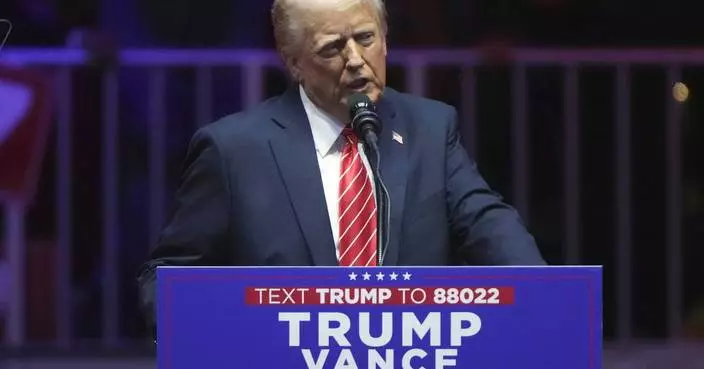

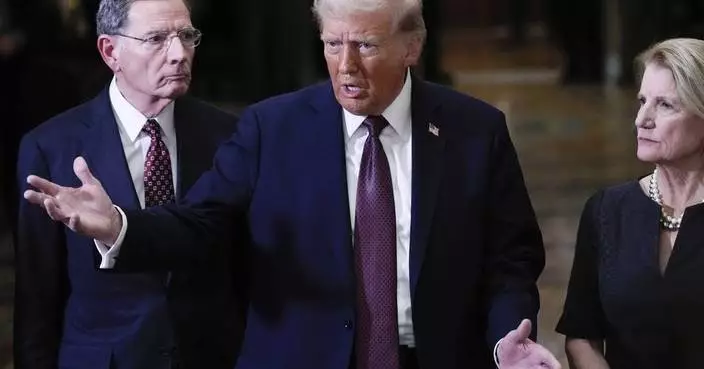

FILE - Donald Trump speaks at the Bitcoin 2024 Conference July 27, 2024, in Nashville, Tenn. (AP Photo/Mark Humphrey, File)