ANN ARBOR, Mich. (AP) — President Joe Biden on Friday signed an executive order for federal grants that will prioritize projects with labor agreements, wage standards, and benefits such as access to child care and apprenticeship programs.

Biden said the ideas in his order “are common sense."

Click to Gallery

ANN ARBOR, Mich. (AP) — President Joe Biden on Friday signed an executive order for federal grants that will prioritize projects with labor agreements, wage standards, and benefits such as access to child care and apprenticeship programs.

President Joe Biden signs an executive order for federal grants that would prioritize projects with labor agreements, wage standards and benefits such as access to child care and apprenticeship programs, during a visit to the U.A. Local 190 Training Center in Ann Arbor, Mich., Friday, Sept. 6, 2024. (AP Photo/Paul Sancya)

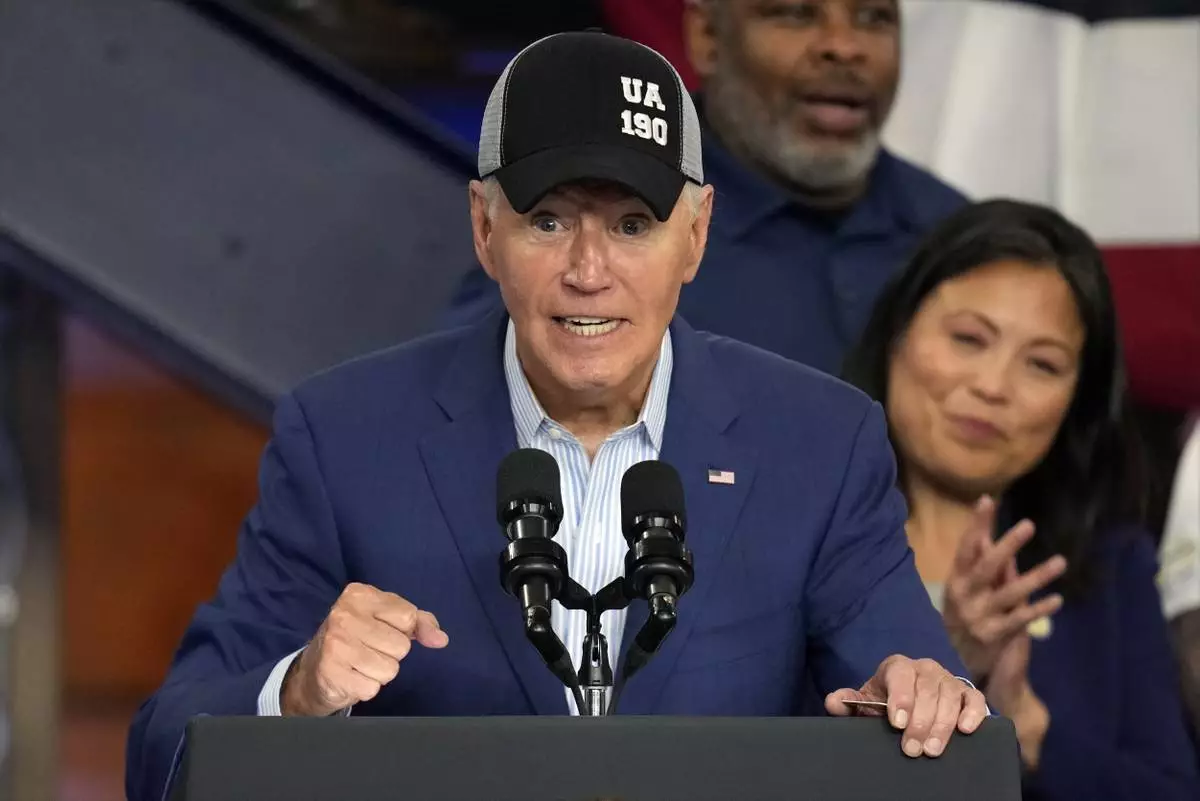

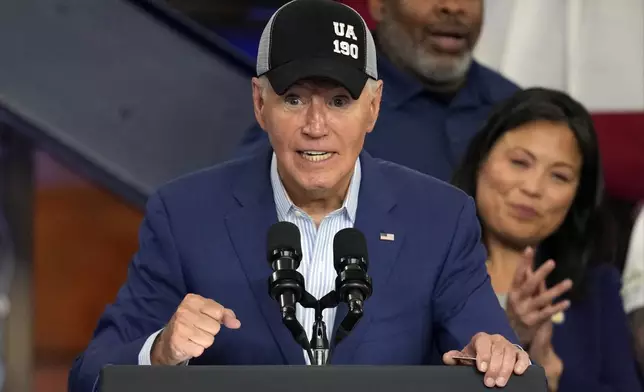

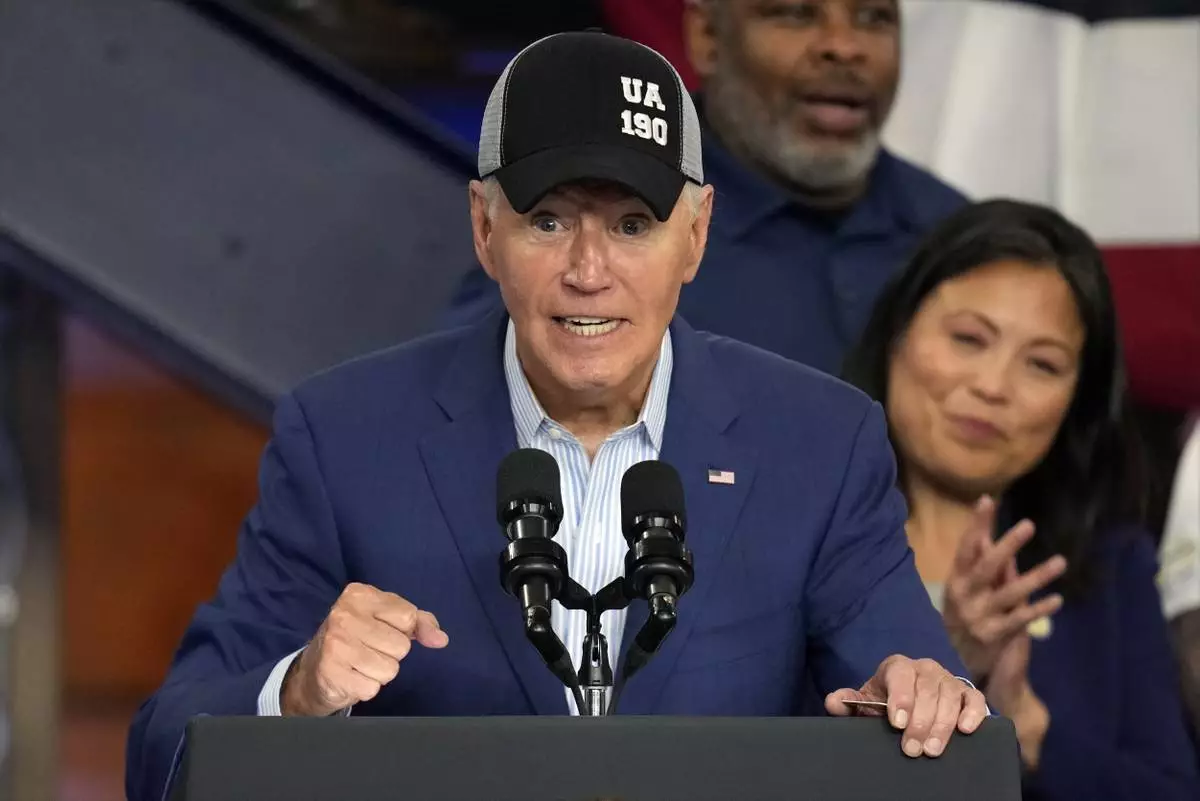

President Joe Biden wears a union hat as he speaks during a visit to the U.A. Local 190 Training Center in Ann Arbor, Mich., Friday, Sept. 6, 2024. (AP Photo/Paul Sancya)

President Joe Biden participates in a signing ceremony after speaking to labor union members about his Investing in America agenda during a visit to the U.A. Local 190 Training Center in Ann Arbor, Mich., Friday, Sep. 6, 2024, as Rep. Debbie Dingell, D-Mich., right, looks on. (AP Photo/Manuel Balce Ceneta)

President Joe Biden arrives at the White House in Washington, Thursday, Sept. 5, 2024, after traveling for the day to Wisconsin. (AP Photo/Rod Lamkey, Jr.)

“Economists have long believed that these good job standards produce more opportunities, better outcomes for workers and more predictable outcomes for businesses as well," he said from an Ann Arbor, Michigan union training center where he made the announcement. “A good union job is building a future worthy of your dreams.”

The Biden administration is trying to make the case that economic growth should flow out of better conditions for workers. His administration has stressed the vital role that organized labor will likely play for Democrats in November’s election. In her matchup against Republican Donald Trump, Vice President Kamala Harris is depending on backing from the AFL-CIO and other unions to help turn out voters in key states.

Biden has prided himself on his support of labor unions, joining striking Michigan union workers on the picket line last year. On Friday, he came on stage to chants of “Thank you, Joe!"

Trump has tried to make inroads with organized labor as well by having Teamsters President Sean O'Brien speak at the Republican National Convention. The Teamsters have yet to formally endorse any candidate, though Harris is expected to meet with them.

Biden said that under his administration "we buy American. And we’re making sure federal projects are made in America projects.”

Some in the construction industry criticized the order for possibly increasing construction costs and excluding non-unionized workers from projects.

“These policies steer taxpayer-funded infrastructure contracts to unionized businesses and create jobs exclusively for union members at the expense of everyone else and the rule of law," said Ben Brubeck, an executive with Associated Builders and Contractors, a construction industry trade group.

The order will establish a task force to coordinate policy development with the goal of ensuring more benefits for workers. The administration's funding for infrastructure, computer chip manufacturing and the development of renewable energy sources has led to a wave of projects.

By the administration's count, its incentives have prompted $900 billion worth of private-sector investments in renewable energy and manufacturing. Those commitments have yet to resonate much with voters who are more focused on the lingering damage caused by inflation spiking in 2022, but many projects will take several years to come to fruition.

Though he wasn't in Michigan for a campaign event, Biden spoke on his predecessor, saying that Trump would much rather “cross a picket line than walk one."

“My predecessor believed America is a failing nation,” Biden said, mentioning an oft-repeated complaint by the president about a 2020 report that Trump had referred to American war dead at the Aisne-Marne American Cemetery in France in 2018 as “losers” and “suckers.”

Trump has denied the report.

“I’m glad I wasn’t there,” Biden said. “I think I would have done something. I think you would have, too.”

Biden added: “He's the sucker. He's the loser.”

Biden’s late son Beau died from cancer in 2015. The president has blamed burn pits for the brain cancer. Burn pits are where chemicals, tires, plastics, medical equipment and human waste were disposed of on military bases and were used in Iraq and Afghanistan.

“I'm sorry to get emotional like that. But I miss him," Biden said before turning his focus back to to union workers, calling them heroes.

Boak reported from Pittsburgh.

President Joe Biden speaks with Rep. Debbie Dingell, D-Mich., at a signing ceremony after speaking to labor union members about his Investing in America agenda during a visit to the U.A. Local 190 Training Center in Ann Arbor, Mich., Friday, Sep. 6, 2024. (AP Photo/Manuel Balce Ceneta)

President Joe Biden signs an executive order for federal grants that would prioritize projects with labor agreements, wage standards and benefits such as access to child care and apprenticeship programs, during a visit to the U.A. Local 190 Training Center in Ann Arbor, Mich., Friday, Sept. 6, 2024. (AP Photo/Paul Sancya)

President Joe Biden wears a union hat as he speaks during a visit to the U.A. Local 190 Training Center in Ann Arbor, Mich., Friday, Sept. 6, 2024. (AP Photo/Paul Sancya)

President Joe Biden participates in a signing ceremony after speaking to labor union members about his Investing in America agenda during a visit to the U.A. Local 190 Training Center in Ann Arbor, Mich., Friday, Sep. 6, 2024, as Rep. Debbie Dingell, D-Mich., right, looks on. (AP Photo/Manuel Balce Ceneta)

President Joe Biden arrives at the White House in Washington, Thursday, Sept. 5, 2024, after traveling for the day to Wisconsin. (AP Photo/Rod Lamkey, Jr.)

WASHINGTON (AP) — American consumers and home buyers, business people and political leaders have been waiting for months for what the Federal Reserve is poised to announce this week: That it's cutting its key interest rate from a two-decade peak.

It's likely to be just the first in a series of rate cuts that should make borrowing more affordable now that the Fed has deemed high inflation to be all but defeated.

Consider Kelly Mardis, who owns Marcel Painting in Tempe, Arizona. About a quarter of Mardis' business comes from real estate agents who are prepping homes for sale or from new home buyers. Customer queries, he recalls, quickly dropped almost as soon as the Fed started jacking up interest rates in March 2022 — and then kept raising rates through July 2023.

As the housing market contracted, Mardis had to lay off about half his staff of 30. It was the worst dry spell he had experienced in 14 years.

After the Fed begins cutting rates on Wednesday, Mardis envisions brighter times ahead. Typically, a succession of Fed rate cuts leads over time to lower borrowing costs for things like mortgages, auto loans, credit cards and business loans.

“I'm 100% sure it would make a difference,” Mardis said. “I'm looking forward to it.”

At the same time, plenty of uncertainty still surrounds this week's Fed meeting.

How much will the policymakers decide to reduce their benchmark rate, now at 5.3%? By a traditional quarter-point or by an unusually large half-point?

Will they keep loosening credit at their subsequent meetings in November and December and into 2025? Will lower borrowing costs take effect in time to bolster an economy that is still growing at a solid pace but is clearly showing cracks?

Chair Jerome Powell emphasized in a speech last month in Jackson Hole, Wyoming, that the Fed is prepared to cut rates to support the job market and achieve a notoriously difficult “soft landing.” That is when the central bank manages to curb inflation without tipping the economy into a steep recession and causing unemployment to surge.

It's not entirely clear that the Fed can pull it off.

One hopeful sign is that as Powell and other Fed officials have signaled that rate cuts are coming, many interest rates have already fallen in anticipation. The average 30-year mortgage rate dropped to 6.2% last week — the lowest level in about 18 months and down from a peak of nearly 7.8%, according to the mortgage giant Freddie Mac. Other rates, like the yield on the five-year Treasury note, which influences auto loan rates, have also tumbled.

“That really does help lower those borrowing costs across the board," said Kathy Bostjancic, chief economist at Nationwide Financial. “That helps to give nice relief to consumers.”

Businesses can now borrow at lower rates than they've been able to for the past year or so, potentially boosting their investment spending.

“The question is if it's helping quickly enough ... to actually deliver the soft landing that everyone's been hoping for," said Gennadiy Goldberg, head of U.S. rates strategy at TD Securities.

Many economists would like to see the Fed announce a half-point rate cut this week, in part because they think the officials should have begun cutting rates at their previous meeting in July. Wall Street traders on Friday signaled their expectation that the Fed will carry out at least two half-point cuts by year's end, according to futures prices.

Yet Goldberg suggested that there would be downsides to implementing a half-point rate cut this week. It might signal to the markets that the Fed's policymakers are more worried about the economy than they actually are.

“Markets could assume that something is wrong and the Fed sees something quite terrible on the horizon,” Goldberg said.

It could also raise expectations for additional half-point cuts that the Fed might not deliver.

In the long run, more important than Wednesday's Fed action is the pace of rate cuts through next year and the ultimate end point. If Fed officials conclude that inflation is essentially defeated and they no longer need to slow the economy, that would suggest that their key rate should be at a more “neutral” setting, which could be as low as 3%. That would require a series of further rate cuts.

Many economists think the economy needs much lower rates. Diane Swonk, chief economist at KPMG, notes that hiring has averaged just 116,000 a month for the past three months, a level equivalent to the sluggish job growth coming out of the 2008-2009 Great Recession. The unemployment rate has risen by nearly a full percentage point to 4.2%.

“There is a fragility out there when you are not hiring at a very strong pace," Swonk said. “This is still a much weaker labor market then we thought we had.”

Still, Fed rate cuts may provide a crucial boost to the economy just when it's needed.

Michele Raneri, head of U.S. research at TransUnion, a credit monitoring company, noted that lower rates typically lead consumers to refinance high interest-rate debt — principally credit card borrowing — into lower-cost personal loans. Doing so would ease their financial burdens.

And once mortgage rates fall below 6%, Raneri said, more homeowners will likely be willing to sell, rather than holding on to their house out of reluctance to swap a low mortgage rate for a much higher one. More home sales would help relieve the supply crunch that's made it hard for younger people to buy a first home.

“That starts to break up this logjam that we’ve been in where there’s a low inventory of houses,” Raneri said. “We need some people to start moving to start that churn.”

Other small businesses are seeing signs that the churn is picking up. Brittany Hart, who owns a software consulting firm in Phoenix that works with mortgage brokers, wealth managers and banks, is noticing more interest from potential clients in adopting new software to boost efficiency. That is because they expect the housing market to pick up.

Hart has started looking for three new employees to help handle the expected business, to add to the roughly 20 employees she has now.

“This is the first leading indicator that we are getting back to that normal activity in the housing market," she said.

FILE - A screen displays a news conference with Federal Reserve Chairman Jerome Powell on the floor at the New York Stock Exchange in New York, May 1, 2024. (AP Photo/Seth Wenig, File)

FILE - Federal Reserve Chair Jerome Powell speaks during a news conference at the Federal Reserve in Washington, May 1, 2024. (AP Photo/Susan Walsh, File)