WASHINGTON (AP) — Democratic vice presidential nominee Minnesota Gov. Tim Walz on Tuesday will unveil his ticket's plans to improve the lives of rural voters, as Vice President Kamala Harris looks to cut into former President Donald Trump's support.

The Harris-Walz plan includes a focus on improving rural health care, such as plans to recruit 10,000 new health care professionals in rural and tribal areas through scholarships, loan forgiveness and new grant programs, as well as economic and agricultural policy priorities. The plan was detailed to The Associated Press by a senior campaign official on the condition of anonymity ahead of its official release on Tuesday.

It marks a concerted effort by the Democratic campaign to make a dent in the historically Trump-leaning voting bloc in the closing three weeks before Election Day. Trump carried rural voters by a nearly two-to-one margin in 2020, according to AP VoteCast. In the closely contested race, both Democrats and Republicans are reaching out beyond their historic bases in hopes of winning over a sliver of voters that could ultimately prove decisive.

Walz is set to announce the plan during a stop in rural Lawrence County in western Pennsylvania, one of the marquee battlegrounds of the 2024 contest. He is also starring in a new radio ad for the campaign highlighting his roots in a small town of 400 people and his time coaching football, while attacking Trump and his running mate, Ohio Sen. JD Vance.

“In a small town, you don’t focus on the politics, you focus on taking care of your neighbors and minding your own damn business," Walz says in the ad, which the campaign said will air across more than 500 rural radio stations in Georgia, Michigan, North Carolina, Pennsylvania and Wisconsin. "Now Donald Trump and JD Vance, they don’t think like us. They’re in it for themselves.”

The Harris-Walz plan calls on Congress to permanently extend telemedicine coverage under Medicare, a pandemic-era benefit that helped millions access care that is set to expire at the end of 2024. They are also calling for grants to support volunteer EMS programs to cut in half the number of Americans living more than 25 minutes away from an ambulance.

It also urges Congress to restore the Affordable Connectivity Program, a program launched by President Joe Biden that expired in June that provided up to $30 off home internet bills, and for lawmakers to require equipment manufacturers to grant farmers the right to repair their products.

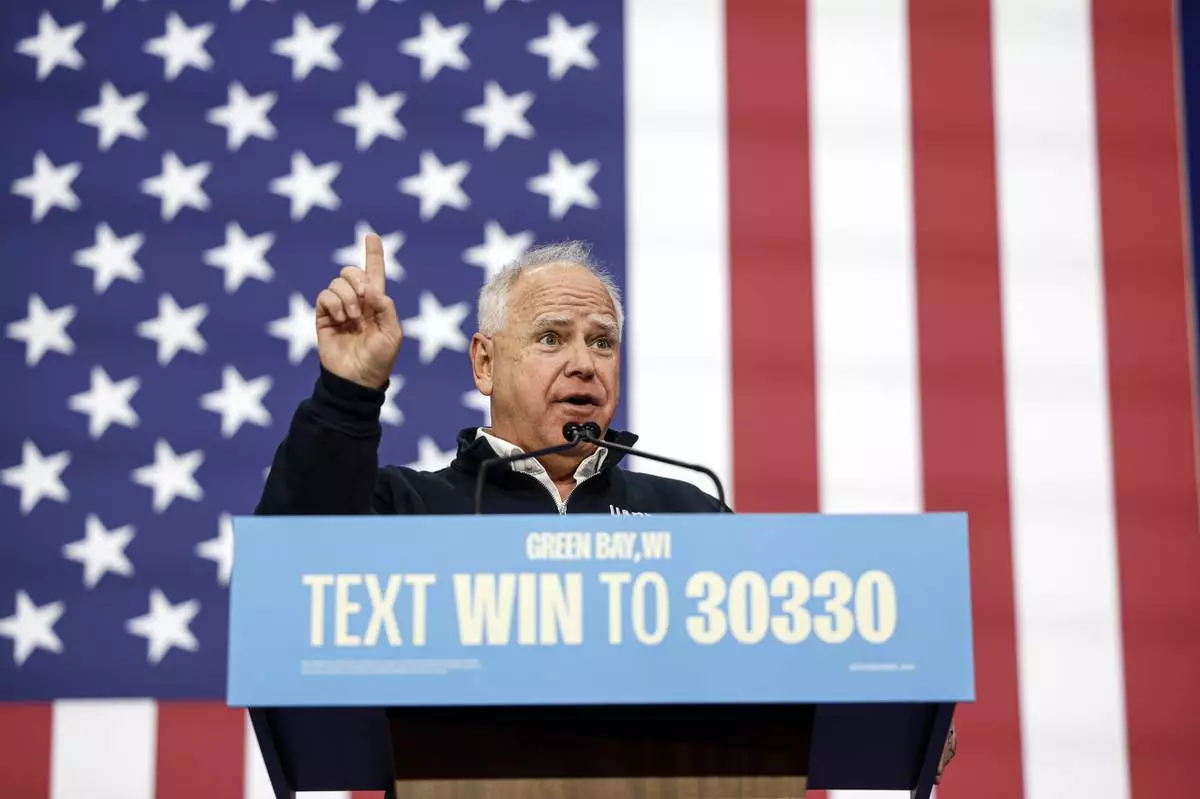

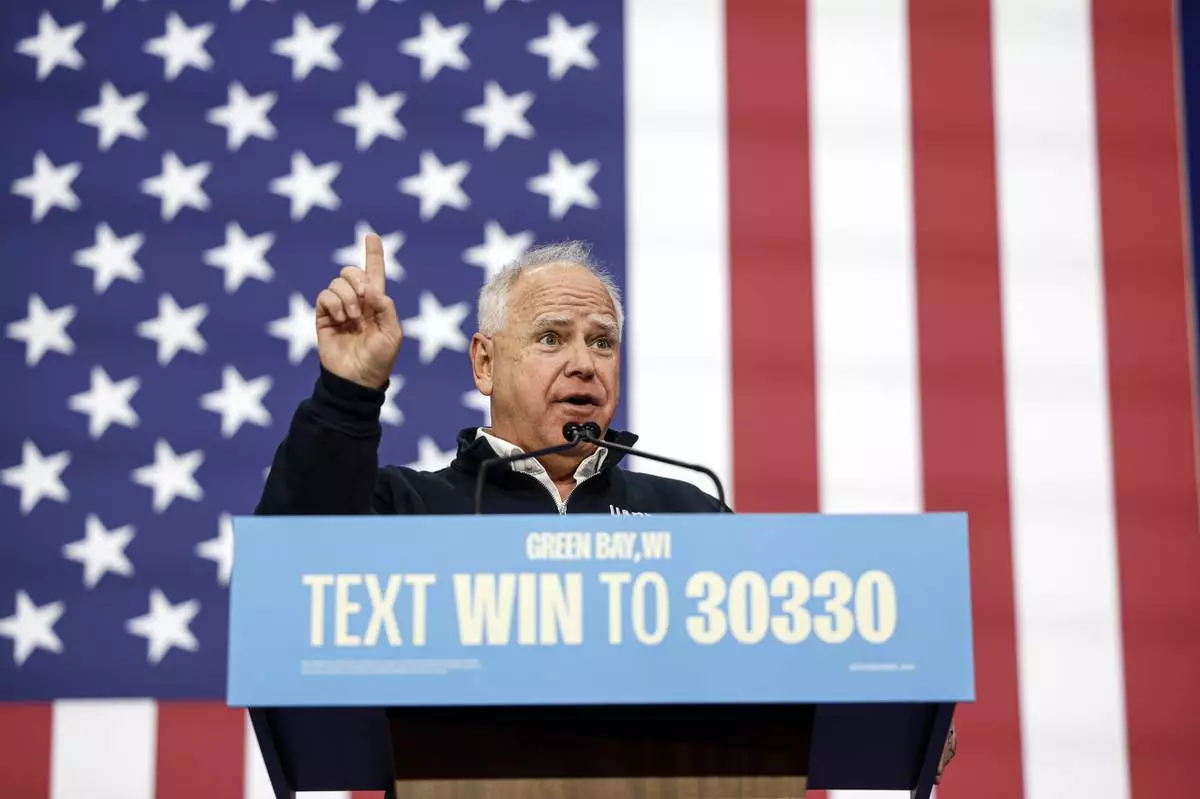

Democratic vice presidential nominee Minnesota Gov. Tim Walz speaks at a campaign event Monday, Oct. 14, 2024, in Green Bay, Wis. (AP Photo/Jeffrey Phelps)

MAGDEBURG, Germany (AP) — Germans on Saturday mourned both the victims and their shaken sense of security after a Saudi doctor intentionally drove into a Christmas market teeming with holiday shoppers, killing at least five people, including a small child, and injuring at least 200 others.

Authorities arrested a 50-year-old man at the site of the attack in Magdeburg on Friday evening and took him into custody for questioning. He has lived in Germany for nearly two decades, practicing medicine in Bernburg, about 40 kilometers (25 miles) south of Magdeburg. officials said.

The governor of the surrounding state of Saxony-Anhalt, Reiner Haseloff, told reporters that the death toll rose from two to five and that more than 200 people in total were injured.

Chancellor Olaf Scholz said that nearly 40 of them "are so seriously injured that we must be very worried about them.”

Several German media outlets identified the suspect as Taleb A., withholding his last name in line with privacy laws, and reported that he was a specialist in psychiatry and psychotherapy.

Mourners lit candles and placed flowers outside a church near the market on the cold and gloomy day. Several people stopped and cried. A Berlin church choir whose members witnessed a previous Christmas market attack in 2016 sang Amazing Grace, a hymn about God's mercy, offering their prayers and solidarity with the victims.

There were still no answers Saturday as to what caused him to drive into a crowd in the eastern German city of Magdeburg.

Describing himself as a former Muslim, the suspect shared dozens of tweets and retweets daily focusing on anti-Islam themes, criticizing the religion and congratulating Muslims who left the faith.

He also accused German authorities of failing to do enough to combat what he said was the “Islamism of Europe.” Some described him as an activist who helped Saudi women flee their homeland. He has also voiced support for the far-right and anti-immigrant Alternative for Germany (AfD) party.

Recently, he seemed focused on his theory that German authorities have been targeting Saudi asylum seekers.

Prominent German terrorism expert Peter Neumann said he had yet to come across a suspect in an act of mass violence with that profile.

“After 25 years in this ‘business’ you think nothing could surprise you anymore. But a 50-year-old Saudi ex-Muslim who lives in East Germany, loves the AfD and wants to punish Germany for its tolerance towards Islamists — that really wasn’t on my radar, " Neumann, the director of the International Centre for the Study of Radicalization and Political Violence at King’s College London, wrote on X.

“As things stand, he is a lone perpetrator, so that as far as we know there is no further danger to the city,” Saxony-Anhalt’s governor, Reiner Haseloff, told reporters. “Every human life that has fallen victim to this attack is a terrible tragedy and one human life too many.”

The violence shocked Germany and the city, bringing its mayor to the verge of tears and marring a festive event that’s part of a centuries-old German tradition. It prompted several other German towns to cancel their weekend Christmas markets as a precaution and out of solidarity with Magdeburg’s loss. Berlin kept its markets open but has increased its police presence at them.

Germany has suffered a string of extremist attacks in recent years, including a knife attack that killed three people and wounded eight at a festival in the western city of Solingen in August.

Magdeburg is a city of about 240,000 people, west of Berlin, that serves as Saxony-Anhalt’s capital. Friday’s attack came eight years after an Islamic extremist drove a truck into a crowded Christmas market in Berlin, killing 13 people and injuring many others. The attacker was killed days later in a shootout in Italy.

Chancellor Scholz and Interior Minister Nancy Faeser traveled to Magdeburg on Saturday, and a memorial service is to take place in the city cathedral in the evening. Faeser ordered flags lowered to half-staff at federal buildings across the country.

Verified bystander footage distributed by the German news agency dpa showed the suspect’s arrest at a tram stop in the middle of the road. A nearby police officer pointing a handgun at the man shouted at him as he lay prone, his head arched up slightly. Other officers swarmed around the suspect and took him into custody.

Thi Linh Chi Nguyen, a 34-year-old manicurist from Vietnam whose salon is located in a mall across from the Christmas market, was on the phone during a break when she heard loud bangs and thought at first they were fireworks. She then saw a car drive through the market at high speed. People screamed and a child was thrown into the air by the car.

Shaking as she described the horror of what she witnessed, she recalled seeing the car bursting out of the market and turning right onto Ernst-Reuter-Allee street and then coming to a standstill at the tram stop where the suspect was arrested.

The number of injured people was overwhelming.

“My husband and I helped them for two hours. He ran back home and grabbed as many blankets as he could find because they didn’t have enough to cover the injured people. And it was so cold," she said.

The market itself was still cordoned off Saturday with red-and-white tape and police vans every 50 meters (about 54 yards). Police with machine pistols guarded every entry to the market.

Some thermal security blankets still lay on the street.

Christmas markets are a German holiday tradition cherished since the Middle Ages, now successfully exported to much of the Western world.

Saudi Arabia’s foreign ministry condemned the attack on X.

Aboubakr reported from Cairo and Gera from Warsaw, Poland.

Two firefighters walk through a cordoned-off area near a Christmas Market, after a car drove into a crowd in Magdeburg, Germany, Saturday, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

A damaged car sits with its doors open after a driver plowed into a busy Christmas market in Magdeburg, Germany, early Saturday, Dec. 21, 2024. (Hendrik Schmidt/dpa via AP)

Police stand at a Christmas market in Magdeburg, Germany, early Saturday, Dec. 21, 2024, after a driver plowed into a group of people at the market late Friday. (Hendrik Schmidt/dpa via AP)

Police stand at a Christmas market in Magdeburg, Germany, early Saturday, Dec. 21, 2024, after a driver plowed into a group of people at the market late Friday. (Hendrik Schmidt/dpa via AP)

A damaged car sits with its doors open after a driver plowed into a busy Christmas market in Magdeburg, Germany, early Saturday, Dec. 21, 2024. (Hendrik Schmidt/dpa via AP)

Police officers and police emergency vehicles are seen at the Christmas market in Magdeburg after a driver plowed into a busy Christmas market in Magdeburg, Germany, Saturday, Dec. 21, 2024. (Matthias Bein/dpa via AP)

Security guards stand in front of a cordoned-off Christmas Market after a car crashed into a crowd of people, in Magdeburg, Germany, Saturday early morning, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

A barrier tape and police vehicles are seen in front of the entrance to the Christmas market in Magdeburg after a driver plowed into a busy Christmas market in Magdeburg, Germany, Saturday, Dec. 21, 2024. (Sebastian Kahnert/dpa via AP)

The car that was crashed into a crowd of people at the Magdeburg Christmas market is seen following the attack in Magdeburg, Germany, Saturday early morning, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

People mourn in front of St. John's Church for the victims of Friday's attack at the Christmas market in Magdeburg, Germany, Saturday, Dec. 21, 2024. (Matthias Bein/dpa via AP)

Police tape cordons-off a Christmas Market, where a car drove into a crowd on Friday evening, in Magdeburg, Germany, Saturday, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

A police officer stands guard at at a cordoned-off area near a Christmas Market, where a car drove into a crowd on Friday evening, in Magdeburg, Germany, Saturday, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

Police officers patrol a cordoned-off area at a Christmas Market, where a car drove into a crowd on Friday evening, in Magdeburg, Germany, Saturday, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

Security guards stand in front of a cordoned-off Christmas Market after a car crashed into a crowd of people, in Magdeburg, Germany, Saturday, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

Emergency services work in a cordoned-off area near a Christmas Market, after a car drove into a crowd in Magdeburg, Germany, Saturday, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

Emergency services work in a cordoned-off area near a Christmas Market, after a car drove into a crowd in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

Emergency services work in a cordoned-off area near a Christmas Market, after a car drove into a crowd in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

Reiner Haseloff, Minister President of Saxony-Anhalt, center, is flanked by Tamara Zieschang, Minister of the Interior and Sport of Saxony-Anhalt, left, and Simone Borris, Mayor of the City of Magdeburg, at a press conference after a car plowed into a busy outdoor Christmas market in Magdeburg, Germany Friday, Dec. 20, 2024. (Hendrik Schmidt/dpa via AP)

Emergency services work in a cordoned-off area near a Christmas Market, after a car drove into a crowd in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

Emergency services work in a cordoned-off area near a Christmas Market, after a car drove into a crowd in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

Emergency services work in a cordoned-off area near a Christmas Market, after a car drove into a crowd in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

A police officer guards at a blocked road near a Christmas Market, after an incident in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

Emergency services attend an incident at the Christmas market in Magdeburg, Germany, Friday Dec. 20, 2024. (Dörthe Hein/dpa via AP)

Emergency services attend an incident at the Christmas market in Magdeburg, Germany, Friday Dec. 20, 2024. (Heiko Rebsch/dpa via AP)

Emergency services attend an incident at the Christmas market in Magdeburg, Germany, Friday Dec. 20, 2024. (Heiko Rebsch/dpa via AP)

A police officer guards at a cordoned-off area near a Christmas Market after an incident in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

In this screen grab image from video, special police forces attend an incident at the Christmas market in Magdeburg, Germany, Friday Dec. 20, 2024. (Thomas Schulz/dpa via AP)

Reiner Haseloff (M, CDU), Minister President of Saxony-Anhalt, makes a statement after an incident at the Christmas market in Magdeburg, Germany, Friday Dec. 20, 2024. (Heiko Rebsch/dpa via AP)

A police officer speaks with a man at a cordoned-off area near a Christmas Market after an incident in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

A policeman is seen at the Christmas market where an incident happened in Magdeburg, Germany, Friday Dec. 20, 2024. (Heiko Rebsch/dpa via AP)

A firefighter walks through a cordoned-off area near a Christmas Market, after a car drove into a crowd in Magdeburg, Germany, Saturday, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

Emergency services work in a cordoned-off area near a Christmas Market, after an incident in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

A view of the cordoned-off Christmas market after an incident in Magdeburg, Germany, Friday Dec. 20, 2024. (Heiko Rebsch/dpa via AP)

A police officer guards at a blocked road near a Christmas market after an incident in Magdeburg, Germany, Friday, Dec. 20, 2024. (AP Photo/Ebrahim Noroozi)

The car that was crashed into a crowd of people at the Magdeburg Christmas market is seen following the attack in Magdeburg, Germany, Saturday early morning, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

Security guards stand in front of a cordoned-off Christmas Market after a car crashed into a crowd of people, in Magdeburg, Germany, Saturday early morning, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

Security guards stand in front of a cordoned-off Christmas Market after a car crashed into a crowd of people, in Magdeburg, Germany, Saturday early morning, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

The car that was crashed into a crowd of people at the Magdeburg Christmas market is seen following the attack in Magdeburg, Germany, Saturday early morning, Dec. 21, 2024. (AP Photo/Ebrahim Noroozi)

Forensics work on a damaged car sitting with its doors open after a driver plowed into a busy Christmas market in Magdeburg, Germany, early Saturday, Dec. 21, 2024. (Hendrik Schmidt/dpa via AP)