SFST's speech at HKQAA 35th Anniversary Forum

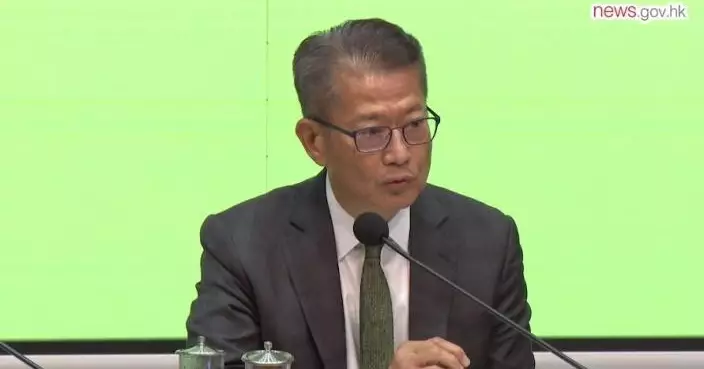

Following is the speech by the Secretary for Financial Services and the Treasury, Mr Christopher Hui, at the HKQAA 35th Anniversary Forum today (October 18):

Chairman Ho (Chairman of the Hong Kong Quality Assurance Agency, Mr Ho Chi-shing), distinguished guests, ladies and gentlemen,

Good afternoon. It is my great pleasure to join you today as we celebrate the 35th anniversary of the Hong Kong Quality Assurance Agency (HKQAA). First, let me extend my warmest congratulations to the HKQAA on this remarkable milestone, and my sincere thanks for the invitation to speak at today's forum.

Today's topic - Sustainable Finance, ESG, and Climate Resilience - could not be more timely or critical, as it highlights the directions we must take to secure the future of not just our economy and financial markets, but our society and planet. I would like to focus on Hong Kong's role and achievements in this area, which I believe can be summed up by a three-A framework: accessibility to capital, availability of opportunity, and accountability to global standards.

Accessibility to capital

Sustainable finance is not just a passing trend. It represents a transformative movement, aligning financial systems with the larger goals of sustainable, inclusive growth. Hong Kong has embraced this vision, emerging as a leading international hub for green finance. In 2023 alone, the total issuance of green and sustainable debt in Hong Kong exceeded US$50 billion, including both bonds and loans, with green and sustainable bonds arranged here accounting for 37 per cent of all such bonds issued across Asia.

This growing accessibility to green capital is not just about numbers. It shows that Hong Kong is well-positioned to channel investments into projects that positively impact the environment and society. We are actively working to expand our green investment product offerings and attract more international issuers to use Hong Kong's green financing market.

By June of this year, the Securities and Futures Commission had authorised over 230 ESG (environmental, social and governance) funds, with total assets under management exceeding HK$1.3 trillion. This represents year-on-year growth of 19 per cent in the number of funds and 8 per cent in assets under management. These investments are not only generating financial returns for investors but also contributing to the well-being of our communities, proving that profitability and purpose can indeed go hand in hand.

Availability of opportunity

As we look to the future, it is vital that we continue to unlock new investment opportunities and encourage innovation in green and sustainable finance. Collaboration across sectors - between government, businesses, and the community - is essential in driving this progress.

One recent example of innovation is Core Climate, a marketplace launched by the Hong Kong Exchanges and Clearing Limited (HKEX) in 2022. Core Climate connects capital with climate-related products and opportunities across Hong Kong, Mainland China, Asia, and beyond. In August this year, the HKEX further enhanced this platform by introducing Gold Standard's Verified Emission Reductions, offering users a seamless, integrated experience.

Hong Kong has also demonstrated its leadership in combining the bond market, green finance, and fintech. In February this year, we successfully issued HK$6 billion worth of tokenised green bonds, denominated in multiple currencies - Hong Kong dollar, Renminbi, US dollar, and euro. This marks our second tokenised bond issuance, following the first in February 2022, and is the world's first multi-currency digitally native green bond.

The success of these initiatives reflects the strength of Hong Kong's green fintech ecosystem, which continues to evolve. By leveraging new technologies, we can amplify efforts to support sustainable development, not only in our local community but across the entire region.

Accountability to global standards

As a global green finance hub, Hong Kong recognises the importance of maintaining accountability and transparency in sustainability efforts. This is why aligning with international standards, notably as the International Sustainability Standards Board (ISSB), is a key priority. We are committed to ensuring that our local sustainability disclosure requirements are aligned with the ISSB Standards, which will significantly enhance Hong Kong's competitiveness in the global sustainable finance arena.

By adopting these internationally recognised standards, we will strengthen our position as a trusted green finance hub while also improving the resilience of our local communities. This alignment will not only foster greater investor confidence but also ensure that our financial sector is well-equipped to meet the challenges of an increasingly sustainability-driven world.

HKQAA's contributions

I would also like to take this opportunity to commend the HKQAA for its significant contributions to Hong Kong's sustainable finance journey. Over the past 35 years, the HKQAA has been a steadfast partner, providing critical quality assurance and helping to uphold rigorous standards for green and sustainable finance. Since the launch of the Government Green Bond Programme in 2019, the HKQAA has played a pivotal role by providing external reviews for each bond issuance, ensuring the credibility and integrity of these instruments.

In addition, the HKQAA has introduced a number of certification schemes, further enhancing stakeholder confidence in green finance products. Their dedication to upholding high standards has been instrumental in positioning Hong Kong as a global leader in this space. Looking ahead, we will continue to count on the HKQAA's expertise as we strive to meet the evolving challenges of sustainable development.

Conclusion

In closing, I would like to emphasise that the future of finance is sustainable finance. As we work towards building a more resilient and sustainable future for Hong Kong and beyond, we must remain committed to the principles of ESG and climate resilience.

Thank you for your attention and your unwavering commitment to sustainable development. Together, we can create a brighter, greener future for generations to come.

HKMA introduces multiple measures to support SMEs' development, upgrade and transformation

The following is issued on behalf of the Hong Kong Monetary Authority:

The Hong Kong Monetary Authority (HKMA), together with the banking sector, introduced multiple measures today (October 18) to further support, through financing as well as banking products and services, the continuous development of small and medium-sized enterprises (SMEs) and assist them in expanding new businesses and markets.

Since the launch of the nine SME support measures by the HKMA and the Banking Sector SME Lending Coordination Mechanism (Mechanism) in March this year, a total of around 20 000 SMEs have benefitted from the measures, involving an aggregate credit limit of over HK$44 billion. The HKMA has also been deepening its understanding of the challenges and needs faced by SMEs of different sectors through various channels and platforms, including the Taskforce on SME Lending (Taskforce) which was established in August this year, and engagement sessions with over 50 trade associations and their members from different industry sectors.

While Hong Kong is currently undergoing economic transformation, the HKMA and the banking sector are aware of the needs of SMEs to strive for change and adapt to changes in the market and business operating environment. Taking into account the views of the commercial sector, the HKMA and the banking sector will roll out the following five measures to assist SMEs' continuous development, upgrade and transformation, and enhance their competitiveness and productivity to cope with various operational challenges:

1. Release of bank capital to facilitate the financing needs of SMEs: The HKMA lowered the countercyclical capital buffer (CCyB) ratio from 1 per cent to 0.5 per cent, and will allow banks to early adopt the preferential treatments for SME exposures under the Basel III capital framework. These policies will release bank capital and thereby enable banks to make use of the additional capital to facilitate the financing needs of SMEs.

2. Set aside dedicated funds to support SMEs: The 16 banks that are active in SME lending have set aside a total of over HK$370 billion of dedicated funds for SMEs in their loan portfolio. The funds will allow SME customers to access necessary financing for coping with the evolving business environment. The banks will regularly review and consider scaling up the size of their dedicated funds in response to SMEs' needs and development.

3. Launch more credit products and services to assist SMEs' transformation: Banks will launch more credit products and services to meet the transformation needs of SMEs. Examples include pre-approved credit limits, unsecured loans, cross-border loans, and loans with flexible repayment periods.

On digital transformation, banks will offer e-commerce financing and electronic payment services to enable SMEs in different sectors such as retail, catering and trading to better utilise data and adopt innovative business solutions, so that SMEs can strengthen their marketing and promotion, streamline business processes and save operating costs.

On green transformation, banks will actively consider launching relevant advisory services.Through collaboration with green certification agencies, banks can alleviate the costs for SMEs to apply for green certification, thereby supporting their low-carbon transition.Banks will also provide green loans to assist SMEs in purchasing and adopting low-carbon equipment, so as to reduce the SMEs'own carbon emissions and transform into green suppliers.

4. Increase the partial principal repayment options: When an orderly exit from the banking sector's Pre-approved Principal Payment Holiday Scheme commenced in July 2023, the Mechanism introduced enhanced measures to assist corporates' gradual return to normal repayment. Since some customers' partial principal repayment arrangements will expire in early 2025, banks will be accommodative and consider offering more flexible repayment arrangements to help these customers to address challenges encountered during economic transformation. Such arrangements include, for instance, extending the duration of partial principal repayment, offering more options on the proportion and duration of partial principal repayment, or even offering principal moratorium, subject to prudent risk-management principles. The above-mentioned arrangements are also applicable to taxi loans, public light bus loans and commercial vehicle loans taken out by personal customers.

5.Devote sufficient manpower and resources to implement the enhancements to SME Financing Guarantee Scheme as soon as possible: Banks will allocate adequate resources to process applications and work closely with HKMC Insurance Limited to implement as soon as possible the principal moratorium and other enhanced measures under the SME Financing Guarantee Scheme.

The HKMA will continue to understand the SME-related business strategies of banks, and maintain close communication with the commercial sectors through the Mechanism and the Taskforce. Seminars and other activities will be organised to promote the SME services, products and schemes offered by the banking sector in the concerted efforts to assist the continuous development, upgrade and transformation of SMEs.

Background

The Banking Sector SME Lending Coordination Mechanism

The Banking Sector SME Lending Coordination Mechanism was established by the HKMA in October 2019. Participants include 11 banks (Note 1)that are most active in SME lending, the Hong Kong Association of Banks (HKAB) and the HKMC Insurance Limited. During the pandemic, the Mechanism rolled out several rounds of relief measures for corporates, including the Pre-approved Principal Payment Holiday Scheme. In March 2024, the HKMA, together with the Mechanism, launched nine measures to assist SMEs in obtaining bank financing and to support their continuous development.

The Taskforce on SME Lending

The Taskforce on SME Lending was jointly established by the HKMA and HKAB in August 2024. Participants include representatives of the HKMA, HKAB and 16 banks (Note 2)that are active in SME lending. The Taskforce aims to further strengthen the related work for supporting SMEs in obtaining bank financing at both the individual case and the industry levels. Participating banks of the Taskforce have stated that they would ensure the ongoing effective implementation of the nine SME support measures that were launched previously, and indicated that they had not changed and would not change their risk appetite towards SME financing and related credit approval standards. The participating banks would also strive to treat customers fairly and communicate with customers in an accommodative manner.

Note 1: Bank of China (Hong Kong), Bank of East Asia, China Construction Bank (Asia), Citibank, Dah Sing Bank, DBS Bank (Hong Kong), Hang Seng Bank, The Hongkong and Shanghai Banking Corporation, Industrial and Commercial Bank of China (Asia), OCBC Bank (Hong Kong), and Standard Chartered Bank (Hong Kong).

Note 2: Including the 11 banks participating in the Mechanism, and Bank of Communications (Hong Kong), China CITIC International, Fusion Bank, Nanyang Commercial Bank and PAO Bank.