Purdue (1-7, 0-5 Big Ten) at No. 3 Ohio State (7-1, 4-1, No. 2 CFP), Saturday, 12 p.m. EST (FOX)

BetMGM College Football Odds: Ohio State by 37 1/2.

Series record: Ohio State leads 41-14-2.

After beating then-No. 3 Penn State last week, Ohio State will try to keep up the same momentum as the Buckeyes face the Big Ten's worst team. The game at the Horseshoe is a bit of letdown for the Buckeyes, who are undoubtedly looking ahead to important games against No. 8 Indiana on Nov. 23 and the rivalry game against Michigan on Nov. 30. Purdue beat Indiana State 49-0 in their opener and lost the last seven.

Ohio State passing game vs. Purdue secondary. Buckeyes quarterback Will Howard has 19 touchdown passes, tied for first in the Big Ten. Freshman Jeremiah Smith has 678 yards receiving and is tied for second in conference with eight TD catches. Purdue is last among in the Big Ten in total defense and 16th out of 18 teams in pass defense.

Purdue: WR CJ Smith. The transfer from Georgia made his Purdue debut last weekend and became a favorite target for QB Hudson Card. Smith caught four passes for 55 yards. Only eight Boilermakers have more receptions than Smith, and his speed and athleticism should help Purdue’s passing game.

Ohio State: Freshman WR Jeremiah Smith has 39 catches for a team-leading 678 yards and eight touchdowns. He's averaging 17.4 yards per catch.

Purdue has lost four of the last five in this series. ... Ohio State has won 10 straight home games against Purdue, dating to Purdue’s 31-26 victory in 1988. ... Purdue has lost two overtime games this season, last weekend against Northwestern and at then No. 23 Illinois on Oct. 12. ... Card is expected to make his second straight start since returning from the concussion protocol last week against Northwestern. ... Purdue’s top rusher, Devin Mockobee, has two 100-yard games this season and rushed 10 times for 29 yards last week against Northwestern. ... The Buckeyes were No. 4 when they beat No. 2 Penn State last week. ... Howard was 16 for 24 for 182 yards and threw touchdown passes to Emeka Egbuka and Brandon Inniss. ... RB Quinshon Judkins rushed for 96 yards against Penn State. He leads Ohio State with 615 yards and six touchdowns.

AP college football: Get poll alerts and updates on the AP Top 25 throughout the season. Sign up here. AP college football: https://apnews.com/hub/ap-top-25-college-football-poll and https://apnews.com/hub/college-football

No. 3 Ohio State will try to keep up the momentum as 1-7 Purdue visits the Horseshoe

No. 3 Ohio State will try to keep up the momentum as 1-7 Purdue visits the Horseshoe

Ohio State wide receiver Emeka Egbuka (2) celebrates a touchdown reception against Penn State during the first quarter of an NCAA college football game, Saturday, Nov. 2, 2024, in State College, Pa. (AP Photo/Barry Reeger)

NEW YORK (AP) — U.S. stocks are ticking higher Thursday, ahead of the Federal Reserve’s announcement coming in the afternoon about what it will do with interest rates.

The S&P 500 was up 0.5% in morning trading, though momentum slowed sharply from its surge a day before following Donald Trump’s presidential victory. The Dow Jones Industrial Average was up 30 points, or 0.1%, as of 10:10 a.m. Eastern time, and the Nasdaq composite was 1.1% higher.

Ralph Lauren was one of the market's leaders and galloped 5.7% higher after customers in Asia and Europe helped it deliver a bigger profit for the latest quarter than expected. Healthcare services company McKesson jumped 8.2% after likewise reporting a stronger profit for the latest quarter than analysts expected.

They helped make up for bank stocks, which gave back some of their stellar gains from the day before. Other “Trump trades” that had rocketed higher after the election also lost some of their juice.

JPMorgan Chase fell 3.3%, a day after banks decisively led the market on expectations that a stronger economy and lighter regulation from Washington would mean fatter profits. Smaller U.S. stocks also lagged the market, with the Russell 2000 index down 0.1%. A day before, it more than doubled the S&P 500's gain on expectations that Trump’s America-First priorities would most benefit smaller, more domestically focused companies.

The stock that’s become most synonymous with the president-elect, Trump Media & Technology Group, fell 17.6%.

In the bond market, the yield on the 10-year Treasury eased to 4.36% from 4.44% late Wednesday. It gave back some of its surge from the prior day, driven by expectations that Trump’s plans for higher tariffs, lower tax rates and lighter regulation could lead to bigger economic growth, inflation and U.S. government debt.

The market’s main event for the day, though, is coming later in the afternoon. Wall Street’s nearly consensus expectation is that the Fed will cut its main interest rate for a second straight time. The central bank began its rate-cutting campaign in September as it focuses more on keeping the job market humming after helping get inflation nearly down to its 2% target.

A report on Thursday showed slightly more U.S. workers applied for unemployment benefits, though the number was what economists expected. A separate preliminary report said U.S. workers improved their productivity during the summer, which can help keep a lid on inflation, but not by quite as much as economists expected.

Trump’s victory may also complicate things for the Fed, and investors are waiting to hear if Chair Jerome Powell will say whether anything will change in its plans.

Trump is pushing for tariffs and other policies that economists say would drive inflation higher, along with the economy’s growth. Traders have already begun paring forecasts for how many cuts to interest rates the Fed will deliver next year because of that. Expectations for such cuts have been a major reason the S&P 500 has set dozens of records already this year.

On Wall Street, Lyft jumped 29.6% after the ride-hailing app breezed past Wall Street’s sales and profit expectations for the latest quarter. Chip company Qualcomm climbed 2% after likewise beating analysts’ profit forecasts.

Match Group tumbled 15.6% after the dating app brand missed revenue targets as its most popular app, Tinder, continued to underperform.

In stock markets abroad, London’s FTSE 100 was virtually flat after the Bank of England cut its own interest rate by a quarter of a percentage point.

In Asia, Japan’s Nikkei 225 slipped 0.3% amid worries about the potential for a revival of trade tensions under a Trump administration.

“I think everybody’s going to be worried about Trump’s tariffs because that’s one of the things in his playbook. And so we’ll have to see how things develop in the early stages of his presidency this time,” said Neil Newman, head of strategy for Astris Advisory Japan.

Stocks rallied 2% in Hong Kong and 2.6% in Shanghai rallied after the Chinese government reported exports jumped in October at the fastest pace in more than two years.

Trump has promised to slap blanket 60% tariffs on all Chinese imports, raising them still more if Beijing makes a move to invade the self-governing island of Taiwan. That would add to the burdens Beijing is facing as it struggles to revive slowing growth in the world’s second-largest economy.

But the impact may be less drastic than feared, Zichun Huang of Capital Economics said in a report.

“We expect shipments to stay strong in the coming months –- any drag from potential Trump tariffs may not materialize until the second half of next year,” Huang said.

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.

A board above the trading floor of the New York Stock Exchange shows the closing number for the Dow Jones industrial average, Wednesday, Nov. 6, 2024. (AP Photo/Richard Drew)

Trader Edward McCarthy works on the floor of the New York Stock Exchange, Wednesday, Nov. 6, 2024. (AP Photo/Richard Drew)

A man passes a video monitor on the side of the New York Stock Exchange in New York's Financial District on Tuesday, Nov. 5, 2024. (AP Photo/Peter Morgan)

A board above the trading floor of the New York Stock Exchange shows the closing number for the Dow Jones industrial average, Wednesday, Nov. 6, 2024. (AP Photo/Richard Drew)

People pass the New York Stock Exchange in New York's Financial District on Tuesday, Nov. 5, 2024. (AP Photo/Peter Morgan)

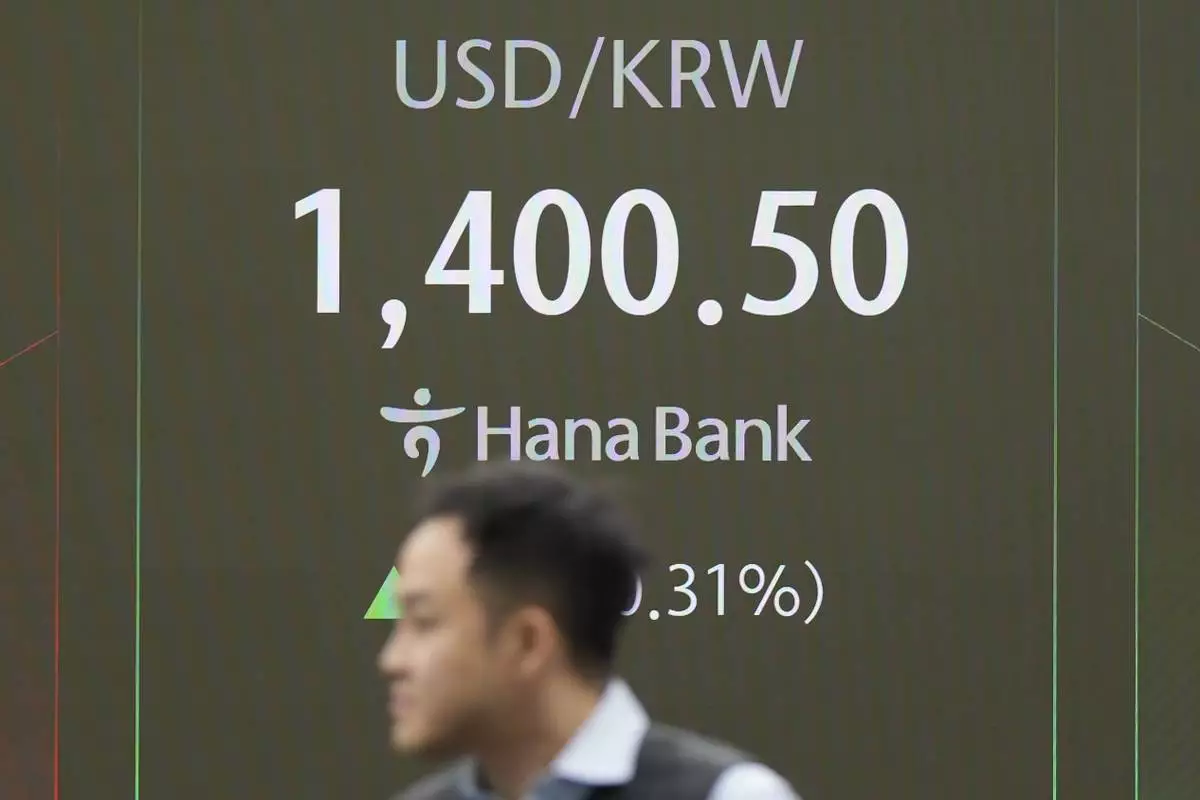

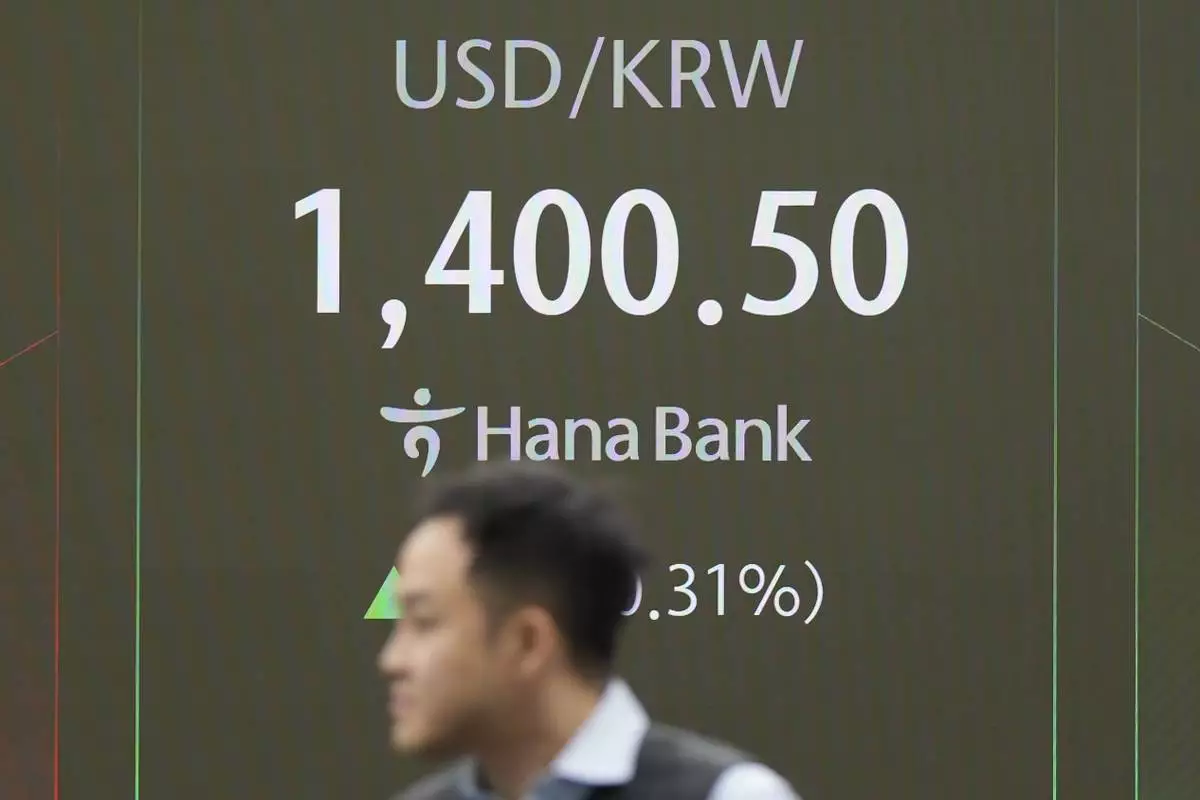

A TV camera screen shows the foreign exchange rate between U.S. dollar and South Korean won and the Korean Securities Dealers Automated Quotations (KOSDAQ) at a foreign exchange dealing room in Seoul, South Korea, Thursday, Nov. 7, 2024. (AP Photo/Lee Jin-man)

Members of media stand near the screens showing the Korea Composite Stock Price Index (KOSPI), left, the foreign exchange rate between U.S. dollar and South Korean won and the Korean Securities Dealers Automated Quotations (KOSDAQ) at a foreign exchange dealing room in Seoul, South Korea, Thursday, Nov. 7, 2024. (AP Photo/Lee Jin-man)

A currency trader talks on the phone at a foreign exchange dealing room in Seoul, South Korea, Thursday, Nov. 7, 2024. (AP Photo/Lee Jin-man)

A tv cameraman films the screens showing the Korea Composite Stock Price Index (KOSPI), left, and the foreign exchange rate between U.S. dollar and South Korean won at a foreign exchange dealing room in Seoul, South Korea, Thursday, Nov. 7, 2024. (AP Photo/Lee Jin-man)

A currency trader walks by the screens showing the Korea Composite Stock Price Index (KOSPI), left, and the foreign exchange rate between U.S. dollar and South Korean won at a foreign exchange dealing room in Seoul, South Korea, Thursday, Nov. 7, 2024. (AP Photo/Lee Jin-man)

A currency trader walks by the screens showing the foreign exchange rate between U.S. dollar and South Korean won at a foreign exchange dealing room in Seoul, South Korea, Thursday, Nov. 7, 2024. (AP Photo/Lee Jin-man)