BEIJING, Nov. 14, 2024 /PRNewswire/ -- Professor Neng Wang, Dean's Distinguished Chair Professor of Finance and Senior Associate Dean at Cheung Kong Graduate School of Business (CKGSB), recently co-authored a paper with Nobel laureate Thomas J. Sargent, among others, published in PNAS entitled "Managing Government Debt". PNAS, or the Proceedings of the National Academy of Sciences, is the journal of the US National Academy of Sciences, often known as one of the three most prestigious general-science journals alongside Nature and Science.

The paper works out a new stochastic model of tax rates and debt/GDP framework for governments to improve fiscal management in uncertain times.

A low debt-to-GDP ratio signals a country is producing more than it owes, placing it on a strong financial footing, whereas a high ratio imperils public services and asset transfer between rich and poor, as a government is pushed to tax more and spend less. The authors extended Barro's model with the risks and opportunities parameters and argue that a government should keep its debt-GDP ratio stable and adopt a stable tax rate that can finance a certain amount of its surplus to GDP. They found that by buying or selling Shiller GDP-linked securities, a government can hedge its primary surplus risk, get risk-free debt, stabilize its debt-to-GDP ratio and keep tax rates level, hence becoming more financially sustainable.

The study offers guidance for finance ministers and the economists behind them to manage government debt with a sustainable mindset, as governments struggle with public spending caps in a post-COVID crisis era.

This paper is co-authored by Neng Wang, CKGSB Dean's Distinguished Chair Professor of Finance; Thomas J. Sargent, Nobel Prize winner in Economics, Professor of Economics at New York University and Senior Fellow at the Hoover Institution at Stanford University; Professor Wei Jiang of the Department of Industrial Engineering and Decision Analytics at the Hong Kong University of Science and Technology; and Professor Jinqiang Yang of the School of Finance at Shanghai University of Finance and Economics.

A follow-up study, already accepted by the Journal of Finance, entitled "A p Theory of Taxes and Debt Management", sees Professor Neng Wang and his co-authors, further exploring the factors that determine the maximal sustainable government debt-to-GDP ratio by showing what happens if there is a debt default.

** The press release content is from PR Newswire. Bastille Post is not involved in its creation. **

CKGSB Professor Neng Wang Co-Authored Paper on Government Debt with Nobel Laureate Thomas J. Sargent Among Others

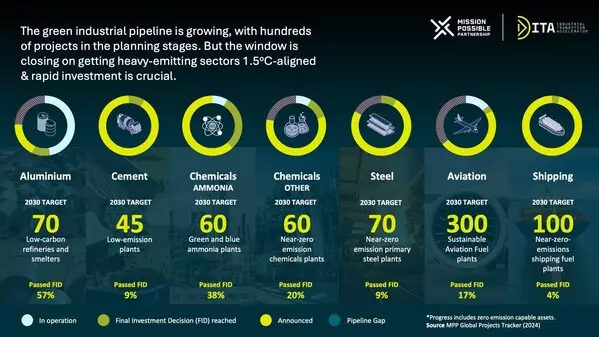

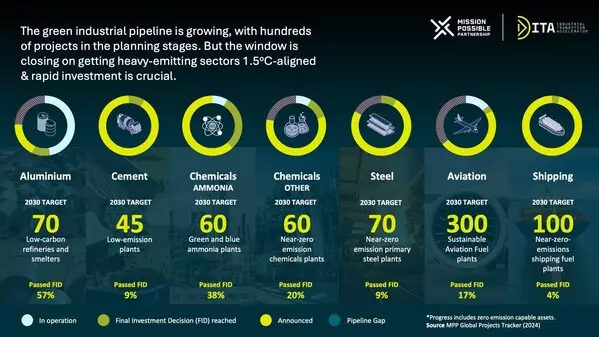

BAKU, Azerbaijan, Nov. 14, 2024 /PRNewswire/ -- Governments must urgently act to stimulate demand for green materials, chemicals and fuels to accelerate the decarbonisation of the world's highest-emitting industries[1], according to 40+ business/ finance leaders and coalitions, representing more than 1,000 companies and financial institutions, in a new open letter. Doing so could unlock up to $1tn[2] of investment and bring more than 500 green industrial plants to construction by 2030. This would enable the emissions reduction needed from aluminium, cement, chemicals, steel, aviation and shipping - to align with a 1.5°C pathway in the next decade.

New data from the ITA and the Mission Possible Partnership (MPP) reveals a growing pipeline of industrial projects. However, < 20% are operational or have the finance and approvals necessary to begin construction. Since April 2024, only eight facilities globally have reached Final Investment Decision (FID), leaving 561 announced but not yet definitively confirmed. 300 of these have been awaiting investment decisions for at least two years. If this rate continues linearly, it would take around 35 years for enough facilities to begin construction[3].

To move to a 1.5°C-aligned trajectory the full pipeline of projects must be financed and begin construction within the next two years[4].

A lack of policies has led to insufficient demand for green products leaving corporations and financiers without the certainty needed for long-term investments. Consequently, projects are stalling. Buyers are unable to commit to long-term offtake agreements at scale due to the continued availability of cheaper, higher-carbon equivalents and lack of incentives to opt for the cleaner option.

Led by the ITA and endorsed by The Glasgow Finance Alliance for Net Zero (GFANZ), the coalition from more than 50 countries, calls for governments to deploy policy measures in the open letter:

Alongside the letter, the ITA has published a Green Demand Policy Playbook setting out evidence-based policy measures available to governments to increase demand for low- and near-zero-carbon materials, chemicals and fuels so as to unlock supply.

[1] Aluminium, cement, chemicals, steel, aviation and shipping

[2] The total investment figures in USD (global and regional) have been calculated using the number of identified projects in the MPP's Global Project Tracker - which uses aggregated data to chart investment progress into net-zero-aligned projects - and publicly available investment data and insight on the amount of investment required for a green industrial plant to reach FID . Sources include: MPP, RMI, Systemiq and BNEF.

[3] 40 years for 552 projects at the pace of 7 projects over 6 months (552/7)/2

[4] The Tracker compares actual investment progress against the MPP's 2030 pipeline targets, representing around 70% of the emissions abatement needed to keep the sectors within their sectoral carbon budgets for 2030 and on track for net zero 2050. The remaining 30% can be achieved through energy and materials efficiency

Infographic: https://mma.prnasia.com/media2/2556879/ITA_Infographic.jpg?p=medium600

** The press release content is from PR Newswire. Bastille Post is not involved in its creation. **

Business and finance call on government to unlock demand for low-carbon products and accelerate industrial projects worth $1,000,000,000