SCOTTSDALE, Ariz.--(BUSINESS WIRE)--Nov 19, 2024--

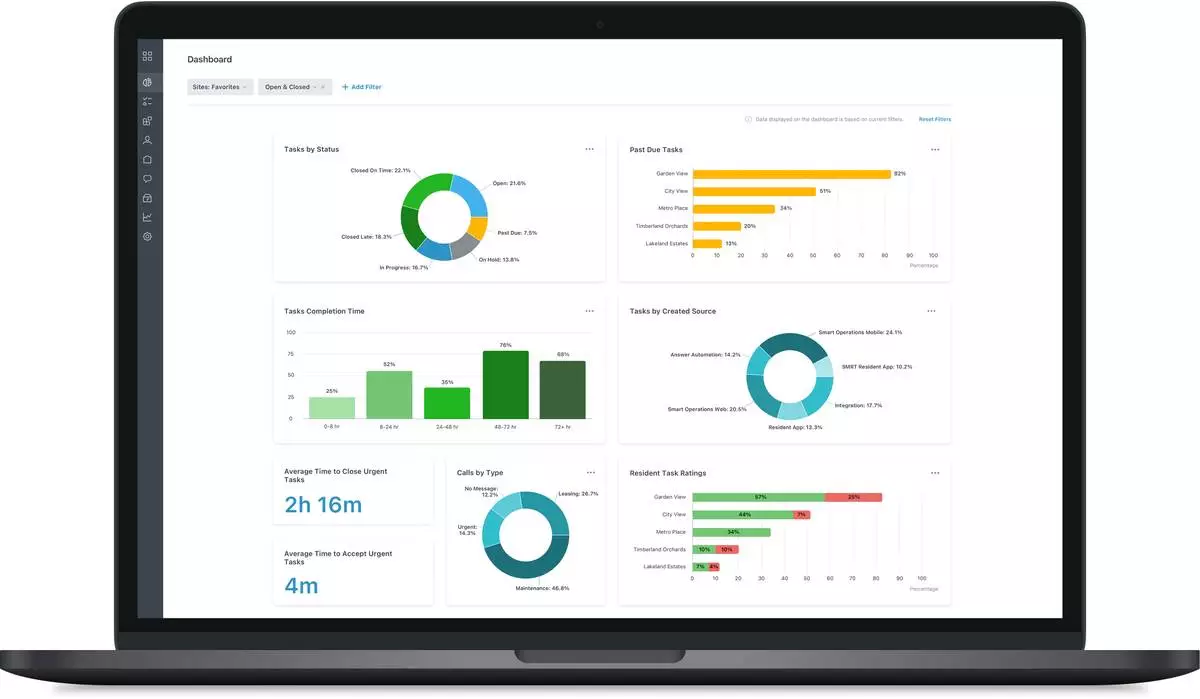

SmartRent, Inc. (NYSE: SMRT) (“SmartRent” or the “Company”), the leading provider of smart communities solutions and smart operations solutions for the rental housing industry, today announced the launch of its maintenance Dashboards designed to optimize property performance through expanded reporting functionality and enhanced visibility from the property level to portfolio managers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241119964801/en/

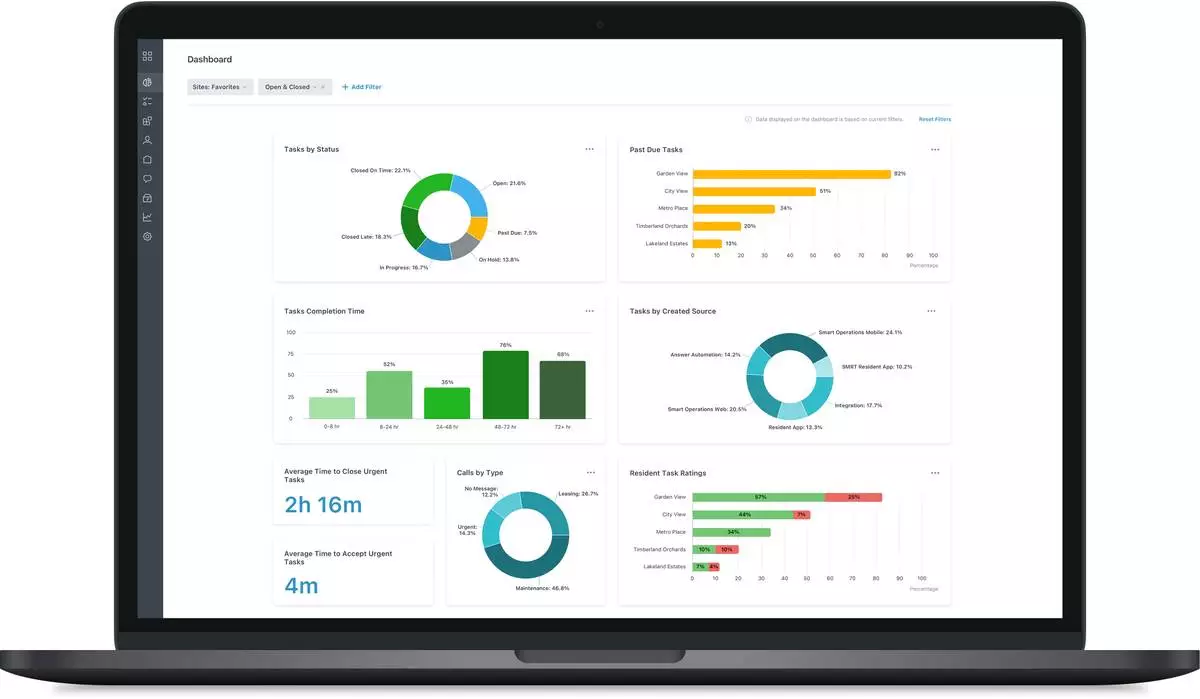

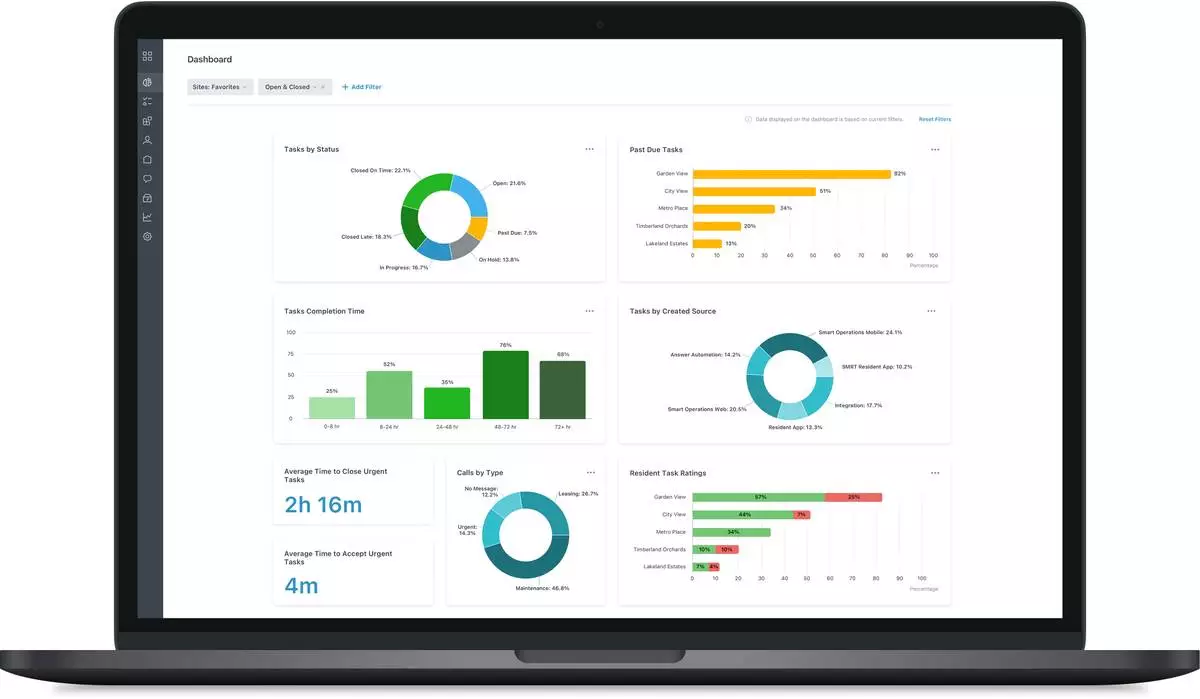

The new Dashboards distill task data from multiple detailed reports into an easily digestible screen, highlighting key performance maintenance metrics at the property, region or portfolio level. Dashboards deliver greater understanding and insights to users across all levels of the organization, providing easy-to-navigate task information to empower informed decisions.

“Delivering technology that solves challenges for our customers and the rental housing industry at large has always been top priority for SmartRent. When we acquired SightPlan, we knew there was a tremendous opportunity to engineer a clearer, more visual way to understand maintenance performance data,” said Isaiah DeRose-Wilson, Chief Technology Officer at SmartRent. “Now, as SightPlan becomes fully integrated into the Smart Operations platform as the Work Management solution, the new advanced Dashboards provide community managers, service technicians and operations teams with actionable data at their fingertips. This data can help to ensure that assets are well-maintained and optimized for efficiency and improved property performance.”

SmartRent Dashboards feature various categories, including: task status, task completion time, past due percentage, resident task ratings, call type, average time to accept urgent tasks, average time to close urgent tasks and tasks by source. Dashboards is a significant feature within SmartRent Work Management (formerly SightPlan) - the workflow management tool used by maintenance teams to streamline and elevate property upkeep.

“Through new Dashboards, maintenance supervisors glean different information from dashboard reporting than portfolio managers, which makes clear and comprehensive visualization of task data essential,” said DeRose-Wilson. “Site teams can focus on open tasks and response times, whereas a broader lens might help to identify widespread trends that require a more extensive response. Dashboards catalog and classify task information into reports that are customizable and aid in centralization of customer operations.”

Centralization and automation have grown in popularity in rental housing as evident with more podded teams being utilized across portfolios. The industry needs a platform that answers centralization by automating task management to create seamless, interconnected workflows for maintenance and operations teams.

Dashboards is part of SmartRent’s commitment to innovative solutions that drive operational efficiency for its customers. It serves as a foundational component for the ongoing development of a dynamic, overarching platform that will create optimal efficiency, reduce workload, enhance team productivity and continue to support the evolving needs of the industry.

Recent platform updates and enhancements, which directly reflect feedback from the 7,600 communities representing 1.3M units and 300 multifamily organizations currently employing the solution, include:

About SmartRent

Founded in 2017, SmartRent, Inc. (NYSE: SMRT) is a leading provider of smart home and smart property solutions for the multifamily industry. The company’s unmatched platform, comprised of smart hardware and cloud-based SaaS solutions, gives operators seamless visibility and control over real estate assets, empowering them to simplify operations, automate workflows and deliver exceptional site team and resident experiences. SmartRent serves 15 of the top 20 multifamily owners and operators, and its solutions enable millions of users to live smarter every day. For more information, please visit www.smartrent.com.

SmartRent's new Dashboards distill task data from multiple detailed reports into an easily digestible screen, highlighting key performance maintenance metrics at the property, region or portfolio level. Dashboards deliver greater understanding and insights to users across all levels of the organization, providing easy-to-navigate task information to empower informed decisions. (Graphic: Business Wire)

NEW YORK (AP) — Nvidia and other tech companies are pulling U.S. stock indexes higher on Tuesday after they stumbled in the morning on worries about escalations in the Russia-Ukraine war.

The S&P 500 was 0.2% higher, as of 2:45 p.m. Eastern time, after erasing an early drop of 0.7%. The Nasdaq composite also shook off an early loss to turn 0.8% higher, while the Dow Jones Industrial Average slipped 154 points, or 0.4%.

Nvidia’s 4.4% climb was the strongest force pushing the S&P 500 upward, and without it, the index would have been down. The chip company’s stock is rallying ahead of its profit report for the latest quarter, which is coming on Wednesday, and vaulting its gain for the year so far above 195% thanks to the craze around artificial-intelligence technology.

Activity in the options market suggests Nvidia’s profit report may be the most anticipated event on Wall Street for the rest of the year, beating out the upcoming jobs report and even the next meeting of the Federal Reserve on interest rates, according to strategists at Barclays Capital.

It’s “a testament to the outsized impact of AI, and the apparent resurgence of upside chasing by” smaller-pocketed, everyday investors known as “retail traders,” according to Barclays’ Stefano Pascale and Anshul Gupta.

Nvidia’s rise helped calm the stock market, even as indexes sank across Europe after Russia said Ukraine fired six U.S.-made ATACMS missiles at it. Earlier in the day, Russian President Vladimir Putin formally lowered the threshold for Russia’s use of its nuclear weapons. Both France’s CAC 40 and Germany’s DAX fell 0.7%.

The worries also sent investors into U.S. Treasury bonds, which are seen as some of the world’s safest investments. The rise in their prices in turn lowered their yields, and the 10-year Treasury yield fell to 4.37% from 4.41% late Monday.

Gold also rose 0.6% and recovered some of the losses it sustained following Donald Trump’s victory in the U.S. presidential election, as investors herded into places traditionally considered safer during times of trouble.

Early in the day, such cautiousness overshadowed optimism coming from reports by big U.S. retailers showing fatter profits for the summer than analysts expected.

Walmart climbed 3.7% after topping forecasts for both profit and revenue. The nation’s biggest retailer said it saw broad-based strength across its categories, including sales made both online and in stores. It also said it served more upper-income households, while raising its forecasts for sales and profit for the full year.

Lowe’s likewise delivered bigger profit and revenue for the latest quarter than analysts expected, but its stock nevertheless dropped 4.2%. A report in the morning said construction crews broke ground on fewer new homes last month than economists expected, and rival Home Depot slipped 0.8%.

Other big companies set to report their latest quarterly results this week include Target on Wednesday and Deere on Thursday.

Elsewhere on Wall Street, Super Micro Computer jumped 31.9% after it filed a plan to keep its stock listed on Nasdaq’s exchange. It hired an independent auditor, BDO USA, which can help it file financial statements needed in order to comply with Nasdaq’s listing requirements.

The company’s stock has been on a wild ride. It more than quadrupled in the first two and a half months of this year because the company makes servers used in AI. But it gave up all that and more, with losses accelerating after Ernst & Young resigned as its public accounting firm. A special committee of the company’s board later said that a three-month investigation found “no evidence of fraud or misconduct on the part of management or the Board of Directors.”

Berry Global Group rose 0.7% after Amcor said it would buy the maker of prescription vials, bags and other products in an all-stock deal. Amcor fell 2.6%.

Incyte dropped 8.6% after the biopharmaceutical company said it’s pausing enrollment in its ongoing study of a potential treatment for hives in chronic spontaneous urticaria. It also said data from another study evaluating a potential treatment for cholestatic pruritus does not support further development.

In stock markets abroad, indexes in Asia were more stable than in Europe. They rose 0.7% in Shanghai and 0.4% in Hong Kong, rebounding from early losses.

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.

FILE - The morning sun shines on Wall Street in New York's Financial District on Tuesday, Nov. 19, 2024. (AP Photo/Peter Morgan)

FILE - People pass the New York Stock Exchange on Nov. 5, 2024, in New York. (AP Photo/Peter Morgan, File)

Currency traders pass by a screen showing the Korea Composite Stock Price Index (KOSPI), left, and the foreign exchange rate between U.S. dollar and South Korean won, center, at the foreign exchange dealing room of the KEB Hana Bank headquarters in Seoul, South Korea, Tuesday, Nov. 19, 2024. (AP Photo/Ahn Young-joon)

Currency traders work near a screen showing the Korea Composite Stock Price Index (KOSPI), left, and the foreign exchange rate between U.S. dollar and South Korean won, center, at the foreign exchange dealing room of the KEB Hana Bank headquarters in Seoul, South Korea, Tuesday, Nov. 19, 2024. (AP Photo/Ahn Young-joon)

A currency trader reacts near a screen showing the Korea Composite Stock Price Index (KOSPI), left, and the foreign exchange rate between U.S. dollar and South Korean won at the foreign exchange dealing room of the KEB Hana Bank headquarters in Seoul, South Korea, Tuesday, Nov. 19, 2024. (AP Photo/Ahn Young-joon)