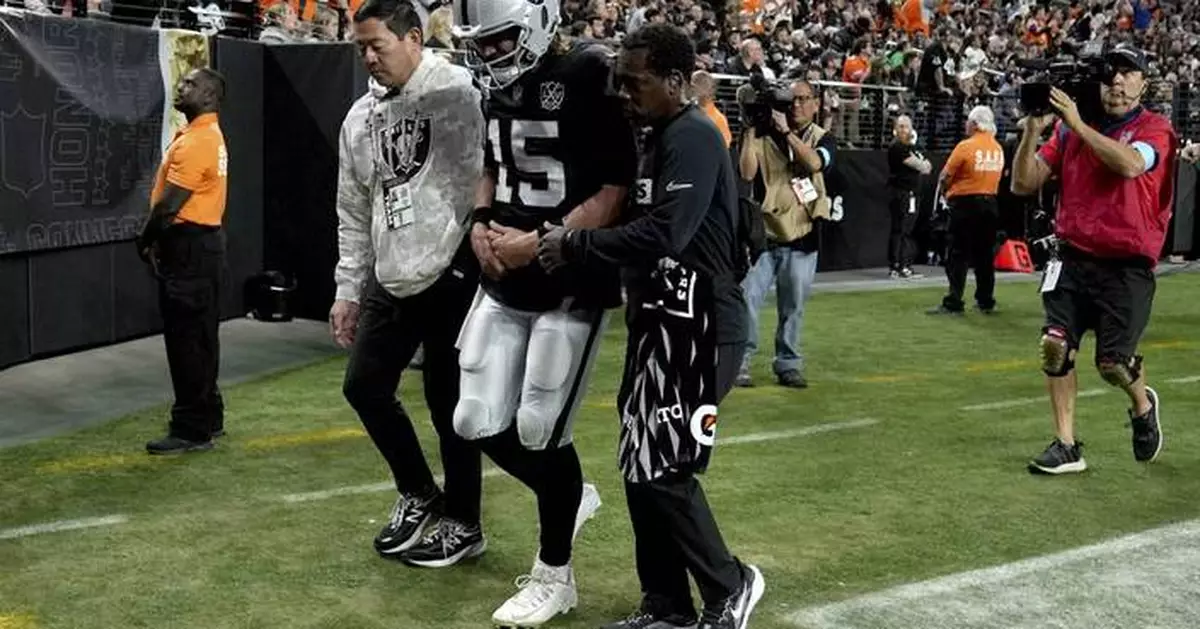

HENDERSON, Nev. (AP) — Las Vegas Raiders quarterback Gardner Minshew is out for the rest of the season with a broken collarbone, coach Antonio Pierce said Monday.

Minshew was injured with 3:12 left in Sunday's 29-19 loss to the Denver Broncos.

Pierce will have to decide whether Aidan O'Connell or Desmond Ridder will start Friday's game at Kansas City.

The Raiders, who have lost seven consecutive games to fall to 2-9, could use a spark. Minshew's grip on the starting job was tenuous even before he was injured. He threw 10 interceptions to just nine touchdown passes this season and Minshew also lost four fumbles.

So it's possible the coaching staff would have eventually turned to O'Connell or Ridder.

O'Connell has been on injured reserve with a broken thumb but was designated to return to practice Monday. That gives the Raiders a three-week-window to decide when to activate him. Until that time, O'Connell will not count against the roster.

Having a short week complicates matters. Pierce said there wouldn't be any typical practices as a result, but there would be way to gauge whether O'Connell is ready to go. Pierce said he would make sure O'Connell would be able to grip the ball without pain.

“Putting a player out there who's hurting or injured still, that's not going to benefit the player or our team,” Pierce said.

O'Connell started the last half of last season as a rookie, guiding the Raiders to a 5-4 record over that time. He lost the starting job to Minshew in the preseason but got it back six games into the season. That's when he was injured a week later against the Los Angeles Rams.

The Raiders also could turn to Ridder, who replaced Minshew when he got hurt Sunday. Las Vegas signed Ridder off Arizona’s practice squad on Oct. 21. He started 13 games in Atlanta last season, passing for 2,836 yards and 12 touchdowns with 12 interceptions.

In relief of Minshew against the Broncos, Ridder completed 5 of 10 passes for 64 yards. He led the Raiders on a last-ditch drive, taking them to Denver's 1-yard line before the game ended.

“He's a competitor,” Pierce said. “Obviously, he was dealt a difficult hand. He was thrown in the fire with no reps, but he did move the ball downfield.”

The Raiders also could take a look at Daniel Jones, though Pierce threw some water on the idea, calling it the “third and fourth” option. Pierce said, however, that general manager Tom Telesco would do due diligence.

Jones was released Friday by the New York Giants. He was the sixth pick in the 2019 NFL draft and went 24-44-1 as the starter. The Giants signed Jones to a four-year, $160 million contract in March 2023.

“We'll see what happens by the end of the day,” Pierce said.

AP NFL: https://apnews.com/hub/NFL

Las Vegas Raiders quarterback Gardner Minshew (15) is assisted by trainers and Head Coach Antonio Pierce, right, after an injury during the second half of an NFL football game against the Denver Broncos, Sunday, Nov. 24, 2024, in Las Vegas. (AP Photo/Rick Scuteri)

Las Vegas Raiders quarterback Gardner Minshew (15) is helped off the field after an injury against he Denver Broncos during the second half of an NFL football game, Sunday, Nov. 24, 2024, in Las Vegas. (AP Photo/Rick Scuteri)

NEW YORK (AP) — Stocks closed higher on Wall Street, sending the Dow Jones Industrial Average to another all-time high. The Dow added 1% Monday to the record it set on Friday. The S&P 500 rose 0.3%, while the Nasdaq composite rose 0.3%. Treasury yields eased in the bond market after President-elect Donald Trump said he wants Scott Bessent, a hedge fund manager, to be his Treasury Secretary. Smaller companies can feel a big boost from easier borrowing costs, and the Russell 2000 index of small stocks jumped 1.5%, closing just shy of the record high it set three years ago.

THIS IS A BREAKING NEWS UPDATE. AP’s earlier story follows below.

NEW YORK (AP) — Wall Street is set to break more records Monday as U.S. stocks rise to add to last week’s gains.

The S&P 500 was 0.2% higher, as of 3 p.m. Eastern time, and sitting just below its all-time high set two weeks ago. The Dow Jones Industrial Average added 397 points, or 0.9%, to its own record set on Friday, while the Nasdaq composite was 0.1% higher.

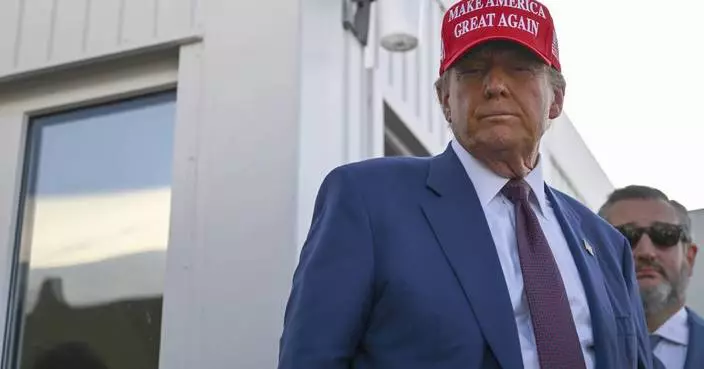

Treasury yields also eased in the bond market amid what some analysts called a “Bessent bounce” after President-elect Donald Trump said he wants Scott Bessent, a hedge fund manager, to be his Treasury Secretary.

Bessent has argued for reducing the U.S. government’s deficit, which is how much more it spends than it takes in through tax and other revenue. Such an approach could soothe worries on Wall Street that Trump’s policies may lead to a much bigger deficit, which in turn would put upward pressure on Treasury yields.

After climbing above 4.44% immediately after Trump’s election, the yield on the 10-year Treasury fell back to 4.26% Monday and down from 4.41% late Friday. That’s a notable move, and lower yields help make it cheaper for all kinds of companies and households to borrow money. They also give a boost to prices for stocks and other investments.

That helped stocks of smaller companies lead the way, and the Russell 2000 index of smaller stocks jumped 2%. It’s set to top its all-time high, which was set three years ago. Smaller companies can feel bigger boosts from lower borrowing costs because of the need of many to borrow to grow.

The two-year Treasury yield, which more closely tracks the market’s expectations for what the Federal Reserve will do with overnight interest rates, also eased sharply.

The Fed began cutting its main interest rate just a couple months ago from a two-decade high, hoping to keep the job market humming after bringing high inflation nearly all the way down to its 2% target. But immediately after Trump’s victory, traders had reduced bets for how many cuts the Fed may deliver next year. They were worried Trump's preference for lower tax rates and higher spending on the border would balloon the national debt. .

A report coming on Wednesday could influence how much the Fed may cut rates. Economists expect it to show that an underlying inflation trend the Fed prefers to use accelerated to 2.8% last month from 2.7% in September. Higher inflation would make the Fed more reluctant to cut rates as deeply or as quickly as it would otherwise.

Goldman Sachs economist David Mericle expects that to slow by the end of next year to 2.4%, but he said inflation would be even lower if not for expected tariff increases on imports from China and autos favored by Trump.

In the stock market, Bath & Body Works jumped 19.1% after delivering stronger profit for the latest quarter than analysts expected. The seller of personal care products and home fragrances also raised its financial forecasts for the full year, even though it still sees a “volatile retail environment” and a shorter holiday shopping season this year.

Much focus has been on how resilient U.S. shoppers can remain, given high prices across the economy and still-high interest rates. Last week, two major retailers sent mixed messages. Target tumbled after giving a dour forecast for the holiday shopping season. It followed Walmart, which gave a much more encouraging outlook.

Another big retailer, Macy’s, said Monday its sales for the latest quarter were in line with its expectations, but it will delay the release of its full financial results. It found a single employee had intentionally hid up to $154 million in delivery expenses, and it needs more time to complete its investigation.

Macy’s stock fell 2.9%.

Among the market's leaders were several companies related to the housing industry. Monday's drop in Treasury yields could translate into easier mortgage rates, which could spur activity for housing. Builders FirstSource, a supplier or building materials, rose 6.2%. Homebuilders, D.R. Horton, PulteGroup and Lennar all rose at least 5.8%.

In stock markets abroad, indexes moved modestly across much of Europe after finishing mixed in Asia.

In the crypto market, bitcoin was trading around $96,800 after threatening to hit $100,000 late last week for the first time.

AP Business Writer Elaine Kurtenbach contributed.

FILE - People work on the New York Stock Exchange trading floor in New York on November 21, 2024. (AP Photo/Ted Shaffrey, File)

FILE - The New York Stock Exchange is shown on Wednesday, Nov. 20, 2024, in New York. (AP Photo/Peter Morgan, File)

A currency trader talks on the phone near the screens showing the foreign exchange rates at a foreign exchange dealing room in Seoul, South Korea, Monday, Nov. 25, 2024. (AP Photo/Lee Jin-man)

Currency traders work near the screens showing the Korea Composite Stock Price Index (KOSPI), left, the foreign exchange rate between U.S. dollar and South Korean won at a foreign exchange dealing room in Seoul, South Korea, Monday, Nov. 25, 2024. (AP Photo/Lee Jin-man)

A currency trader talks on the phone near the screen showing the foreign exchange rate between U.S. dollar and South Korean won at a foreign exchange dealing room in Seoul, South Korea, Monday, Nov. 25, 2024. (AP Photo/Lee Jin-man)

A currency trader walks near the screens showing the Korea Composite Stock Price Index (KOSPI), left, the foreign exchange rate between U.S. dollar and South Korean won and the Korean Securities Dealers Automated Quotations (KOSDAQ) at a foreign exchange dealing room in Seoul, South Korea, Monday, Nov. 25, 2024. (AP Photo/Lee Jin-man)