South Korean financial markets have fluctuated violently in the wake of political turmoil and the short-lived implementation of martial law from Tuesday evening to Wednesday morning.

South Korean President Yoon Suk-yeol declared emergency martial law Tuesday night in a televised emergency address, claiming to eradicate "anti-state" forces and uphold free constitutional order, marking the first martial law declaration since the country's military dictatorship ended in the late 1980s. He lifted the order hours later in accordance with a vote by the country's parliament.

The won-dollar exchange rate fell to 1,446 won to the dollar during night trading after martial law was declared, the lowest in 15 years. The exchange rate has risen to 1,414 won to the dollar as of 18:30 local time (0930 GMT).

After lengthy deliberation, the South Korean government finally confirmed that the financial market would trade normally more than an hour before the opening, and the Korean Composite Stock Price Index fell by about 2 percent during the day.

Experts said that Yoon's maneuver was likely rooted in the country's financial and trade woes, noting that forceful measures may be necessary to ensure prolonged stability.

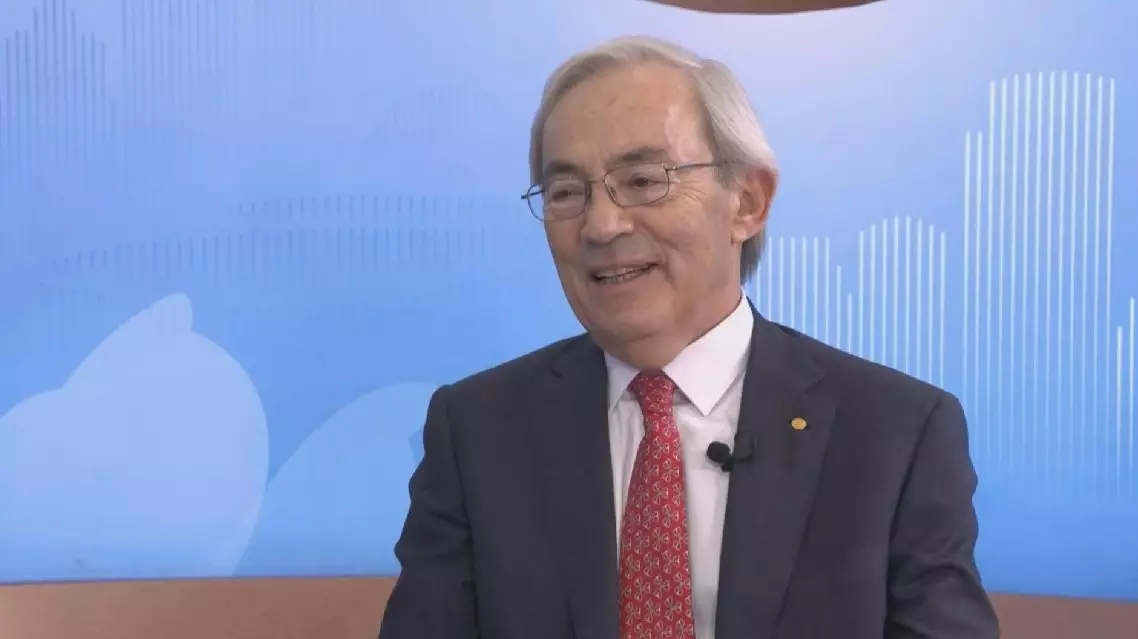

"It's not a positive time for South Korea. The memory chip cycle is on a downturn, as you can see that the October exports are in contraction, and the BOK had to cut rates, domestic demand is rather weak, so we really need a strong government to have a budget that is fiscally supportive, not for the short term but longer term to deal with a lot of challenges," said Trinh Nguyen, senior economist at investment banking company Natixis.

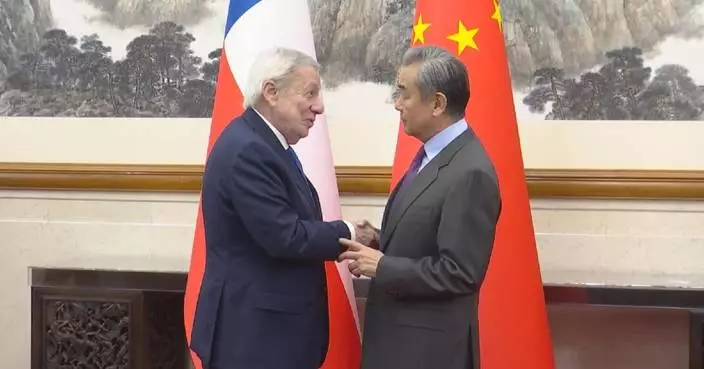

"Railroading efforts by the opposition party by the weekend to starve the presidential office and some of the offices that report to him of crucial revenue for next year, which for Yoon, I think, crossed the Rubicon a bit in terms of political maneuvers, and if anything was was one of the reasons why he was willing to escalate a bit and declare martial law," said Jeremy Chan, senior analyst for China and Northeast Asia at Eurasia Group.

In order to cope with continued market instability, the country's Ministry of Economy and Finance has geared up for measures including providing unlimited liquidity to financial markets when necessary.

Financial Services Commission on Wednesday morning stated that a stock market stabilization fund of 10 trillion won (about 7 billion U.S. dollars) will be put into operation at any time.

S Korean financial markets fluctuate sharply after martial law turmoil