NEWPORT BEACH, Calif.--(BUSINESS WIRE)--Dec 19, 2024--

Aristotle Pacific Capital, a registered investment adviser specializing in credit, has strengthened its deep investment team with the recent additions of Ivor Schucking and Jeff Klingelhofer.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241219047980/en/

Ivor Schucking, a 32-year veteran in the asset-management industry, has been brought on as managing director and head of credit research. Schucking most recently spent 14 years as a senior research analyst and global head of financials credit research at Western Asset Management. Prior to Western Asset, Schucking spent over 12 years at PIMCO as a credit analyst and head of Global Credit Research and four years at Strong Capital Management as director of Credit Research. He holds a bachelor’s degree from New York University and an MBA from New York University Stern School of Business.

“It is exciting to join a highly respected credit manager with a pristine track record, great people and a bright future,” Schucking said.

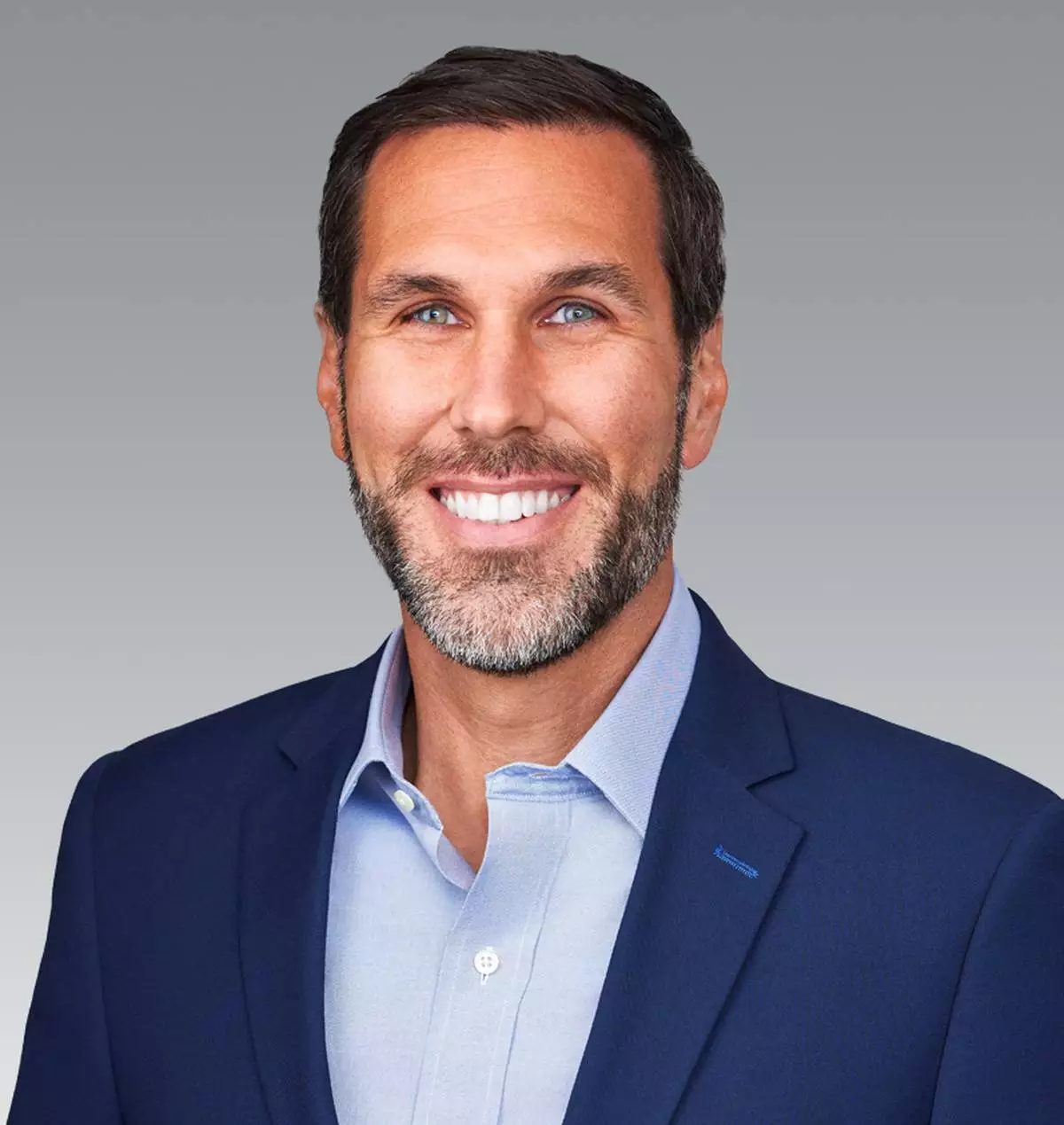

Jeff Klingelhofer has also joined Aristotle Pacific as a managing director and portfolio manager. Prior to joining Aristotle Pacific, he was co-head of Investments and a portfolio manager at Thornburg Investment Management, where he oversaw all fixed-income strategies and led the firm’s securitized investment initiatives. He played a key role in shaping the firm’s investment processes and represented the team in various external business channels. Prior to Thornburg, Klingelhofer was with PIMCO in its Newport Beach, Tokyo, and London offices. With over 20 years of experience in the investment industry, he holds a bachelor’s degree from UC Irvine and an MBA from the University of Chicago Booth School of Business.

“I am excited to join the team at Aristotle Pacific and contribute to the firm’s continued excellence in fixed income,” Klingelhofer said.

As part of his role, Klingelhofer has been named a portfolio manager on Aristotle Pacific’s newly launched Credit Opportunities strategy alongside three firm veteran portfolio managers. The Credit Opportunities strategy is a multi-sector strategy focused on higher-spread credit and securitized investments, including bank loans, high-yield bonds, CLO tranches, and securitized assets.

“We feel very fortunate to add these talented, experienced and respected financial professionals to our team,” said Aristotle Pacific CEO Dominic Nolan. “These additions provide increased depth, leadership, and enhance our potential investment alpha while adding broader familiarity to the organization.”

Since the start of 2024, Aristotle Pacific’s assets under management have increased over 21% and stand at a company-record $29.86 billion (as of Nov. 30, 2024). Founded in 2010, Aristotle, with equity and fixed income capabilities, currently manages approximately $104 billion firmwide.

About Aristotle Pacific

Aristotle Pacific Capital is a Newport Beach, Calif.-based registered investment adviser that actively invests in credit securities on the basis of fundamental credit analysis with the objective of identifying and realizing relative value. The firm manages credit strategies across floating-rate loans, CLOs, multi-sector, high-yield, investment-grade, and short-duration bonds.

About Aristotle

Aristotle Capital Management, LLC and its affiliates, collectively known as “Aristotle,” represent a group of independent investment advisers that provide equity and fixed-income management solutions across a unified platform. Aristotle’s clients include corporate and public pension plans, supranational organizations, financial institutions, insurance companies, endowments and foundations, as well as financial advisors and high-net-worth individuals. Aristotle has a global client base spanning North America, EMEA, and APAC. Each Aristotle affiliate is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. For market commentary, news and insights from all Aristotle affiliates, please visit www.aristotlecap.com.

Jeff Klingelhofer, Managing Director and Portfolio Manager, Aristotle Pacific (Photo: Business Wire)

Ivor Schucking, Managing Director and Head of Credit Research, Aristotle Pacific (Photo: Business Wire)