MILAN (AP) — Italian Premier Giorgia Meloni’s government vowed on Monday to open controversial migrant processing centers in Albania that have remained dormant after Italian courts refused to validate the transfer of the first two groups of migrants.

Government ministers “repeated the firm intention to continue to work … on so-called ‘innovative solutions’ to the migration phenomenon,’’ Meloni’s office said in a statement. It gave no timeline.

The statement cited a court ruling last week by Italy's highest court that said Italian judges could not substitute for government policy on deciding which countries are safe for repatriation of migrants whose asylum requests are rejected.

The decision does allow lower courts to make such determinations on a case-by-case basis, short of setting overall policy.

Meloni told reporters in Finland over the weekend that the high court ruling “had substantially proved the Italian government was correct.”

Italy has earmarked 650 million euros ($675 million) to run the centers over five years. The centers opened in October ready to accept up to 3,000 male migrants a month picked up by the Italian coast guard in international waters.

But two groups of migrants who were brought to Albania by an Italian coast guard ship were instead routed back to Italy after courts refused to validate their transfer.

The Italian courts both asked the European Court of Justice to determine a list of safe countries for repatriation. The timing of the European court decision was not clear, but was expected to take months.

The statement from Meloni's office said the plan to process migrants outside EU borders in Albania had received strong backing from other leaders on the sidelines of last week's EU summit in Brussels.

A hard-line approach to migration got another boost last week when Italian Vice Premier Matteo Salvini was acquitted of a charge of illegally detaining migrants whom he blocked from disembarking in Italy while he was interior minister in August 2019.

Follow AP’s global migration coverage at https://apnews.com/hub/migration

Italy's Prime Minister Giorgia Meloni attends a press conference during the North-South Summit in Inari, Finland, Sunday, Dec. 22, 2024. (Antti Aimo-Koivisto/Lehtikuva via AP)

NEW YORK (AP) — Stocks edged lower in morning trading on Wall Street Monday at the start of a holiday-shortened week.

The S&P 500 fell 0.2%. A handful of technology companies helped cushion the widespread losses. The Dow Jones Industrial Average slipped 308 points, or 0.7% as of 10:59 a.m. Eastern time. The tech-heavy Nasdaq composite was mostly unchanged.

Semiconductor giant Nvidia, whose enormous valuation gives it an outsize influence on indexes, rose 1.2%. Broadcom jumped 3.8% to also help support the broader market.

Japanese automakers Honda Motor and Nissan said they are talking about combining in a deal that might also include Mitsubishi Motors. Honda rose 3.8% and Nissan rose 1.6% in Tokyo.

Eli Lilly rose 2% after announcing that regulators approved Zepbound as the first and only prescription medicine for adults with sleep apnea.

Department store Nordstrom fell 1.3% after it agreed to be acquired and taken private by Nordstrom family members and a Mexican retail group in a $6.25 billion deal.

Business group The Conference Board said that consumer confidence slipped in December. Its consumer confidence index fell back to 104.7 from 112.8 in November. Wall Street was expecting a reading of 113.8.

The unexpectedly weak consumer confidence update follows several generally strong economic reports last week. One report showed the overall economy grew at a 3.1% annualized rate during the summer, faster than earlier thought. The latest report on unemployment benefit applications showed that the job market remains solid.

A report on Friday said a measure of inflation the Federal Reserve likes to use was slightly lower last month than economists expected. Worries about inflation edging higher again had been weighing on Wall Street and the Fed. The central bank has signaled that it could deliver fewer cuts to interest rates next year than it earlier expected because of concerns over inflation.

The central bank just delivered its third cut to interest rates this year, but inflation has been hovering stubbornly above its target of 2%. Expectations for more interest rate cuts have helped drive a 24% gain for the S&P 500 in 2024. That drive included 57 all-time highs this year.

Treasury yields edged higher in the bond market. The yield on the 10-year Treasury rose to 4.56% from 4.53% late Friday.

European markets were mostly lower, while markets in Asia gained ground.

Wall Street has several other economic reports to look forward to this week. On Tuesday, the U.S. will release its November report for sales of newly constructed homes. A weekly update on unemployment benefits is expected on Thursday.

Markets in the U.S. will close early on Tuesday for Christmas Eve and will remain closed on Wednesday for Christmas.

FILE - Signs mark the intersection of Wall and South Streets in New York's Financial District on Nov. 26, 2024. (AP Photo/Peter Morgan, File)

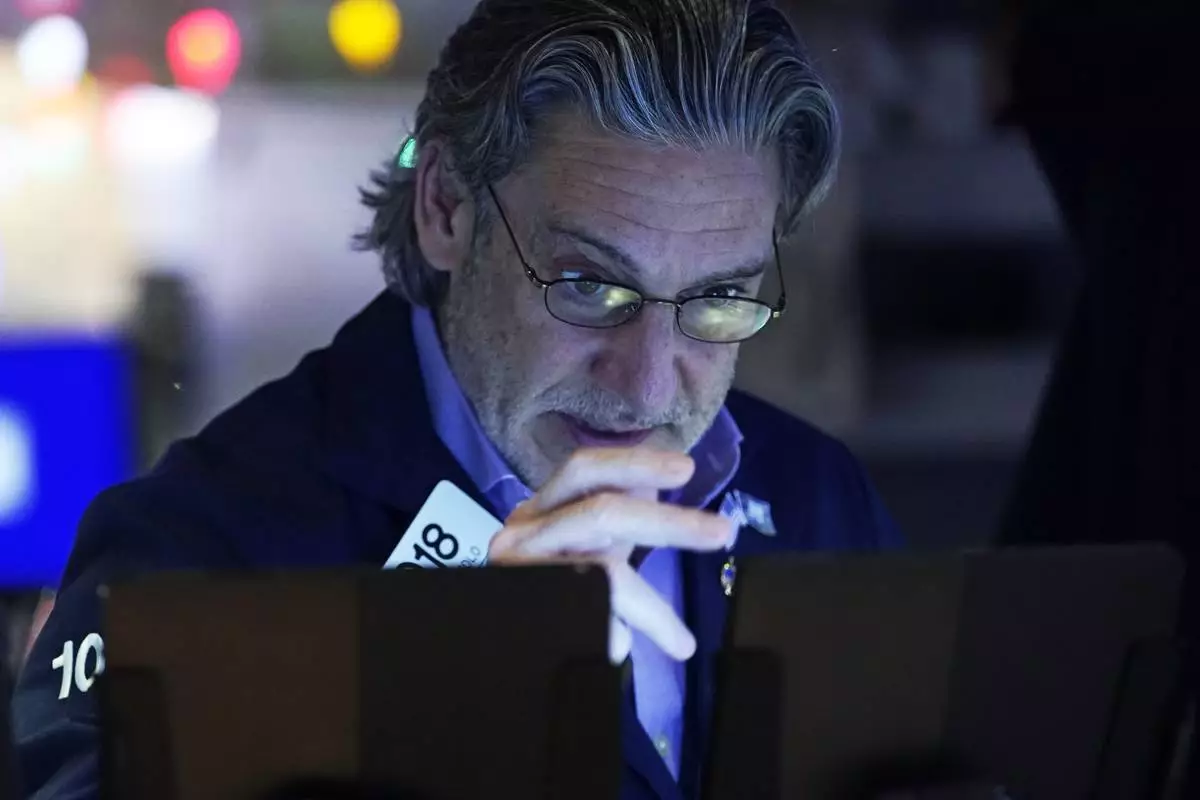

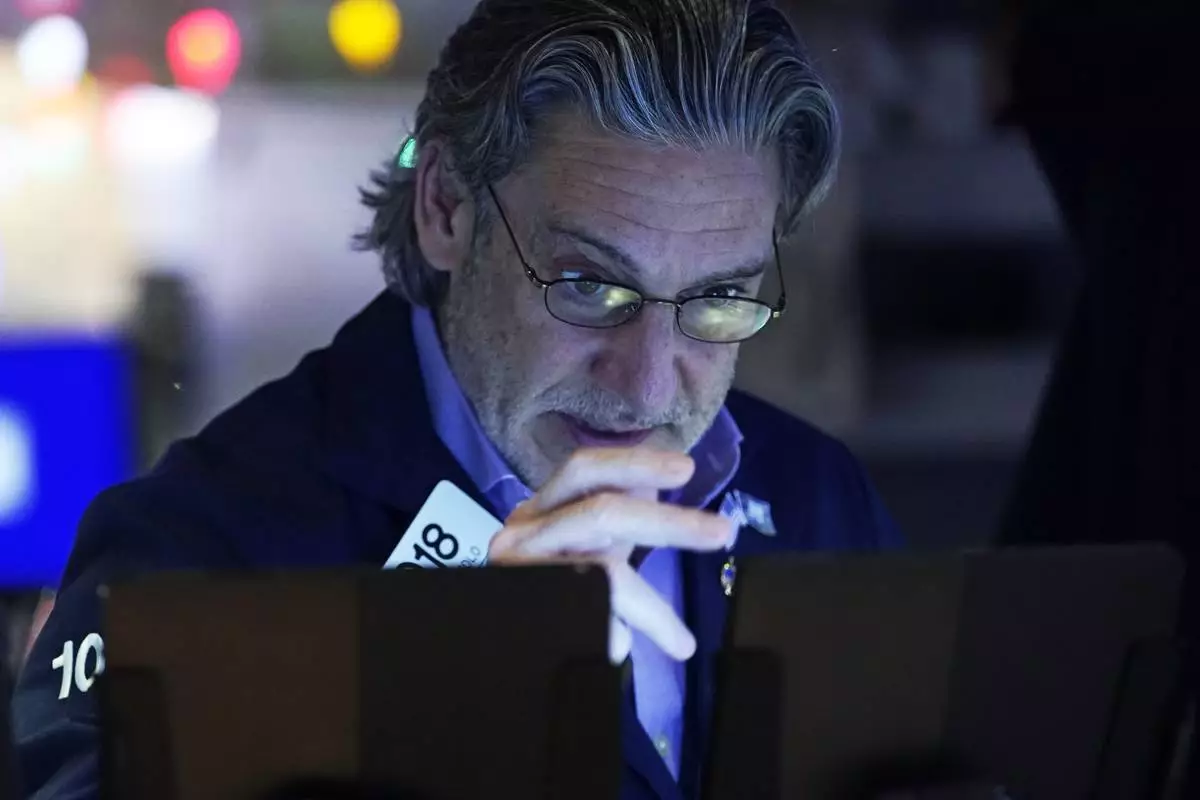

Trader John Romolo works on the floor of the New York Stock Exchange, Wednesday, Dec. 18, 2024. (AP Photo/Richard Drew)

A person looks at an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 23, 2024, in Tokyo. (AP Photo/Eugene Hoshiko)

People walk in front of an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 23, 2024, in Tokyo. (AP Photo/Eugene Hoshiko)

People walk in front of an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 23, 2024, in Tokyo. (AP Photo/Eugene Hoshiko)

People stand near an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 23, 2024, in Tokyo. (AP Photo/Eugene Hoshiko)

A person walks in front of an electronic stock board showing Japan's Nikkei index at a securities firm Monday, Dec. 23, 2024, in Tokyo. (AP Photo/Eugene Hoshiko)