MELBOURNE, Australia (AP) — Novak Djokovic did not want to rehash — or even discuss at all, really — what he said Friday was a months-old interview with GQ magazine in which he recalled having high levels of metal in his blood from food he was served while detained before being deported from Australia in 2022.

“I would appreciate not talking more in detail about that, as I would like to focus on the tennis and why I’m here,” Djokovic said ahead of the Australian Open, which starts Sunday (Saturday EST).

“If you want to see what I’ve said and get more info on that, you can always revert to the article,” Djokovic said about the piece posted online this week.

Djokovic is working with Andy Murray as his coach in Australia in a bid to become the first player in tennis history with 25 Grand Slam singles titles.

In a lengthy GQ story that covered several topics, Djokovic spoke about what happened three years ago, when he was not vaccinated against COVID-19 and was kicked out of Australia.

“I had some health issues. And I realized that in that hotel in Melbourne, I was fed with some food that poisoned me," he said. "I had some discoveries when I came back to Serbia. I never told this to anybody publicly, but ... I had a really high level of heavy metal. Heavy metal. I had ... very high level of lead and mercury.”

The 37-year-old Serbian did not directly answer at the end of Friday's news conference when asked whether he had any evidence linking the blood levels he described to GQ to the food he ate in detention.

AP tennis: https://apnews.com/hub/tennis

Serbia's Novak Djokovic plays a forehand return to Germany's Alexander Zverev during an exhibition match ahead of the Australian Open tennis championship in Melbourne, Australia, Thursday, Jan. 9, 2025. (AP Photo/Vincent Thian)

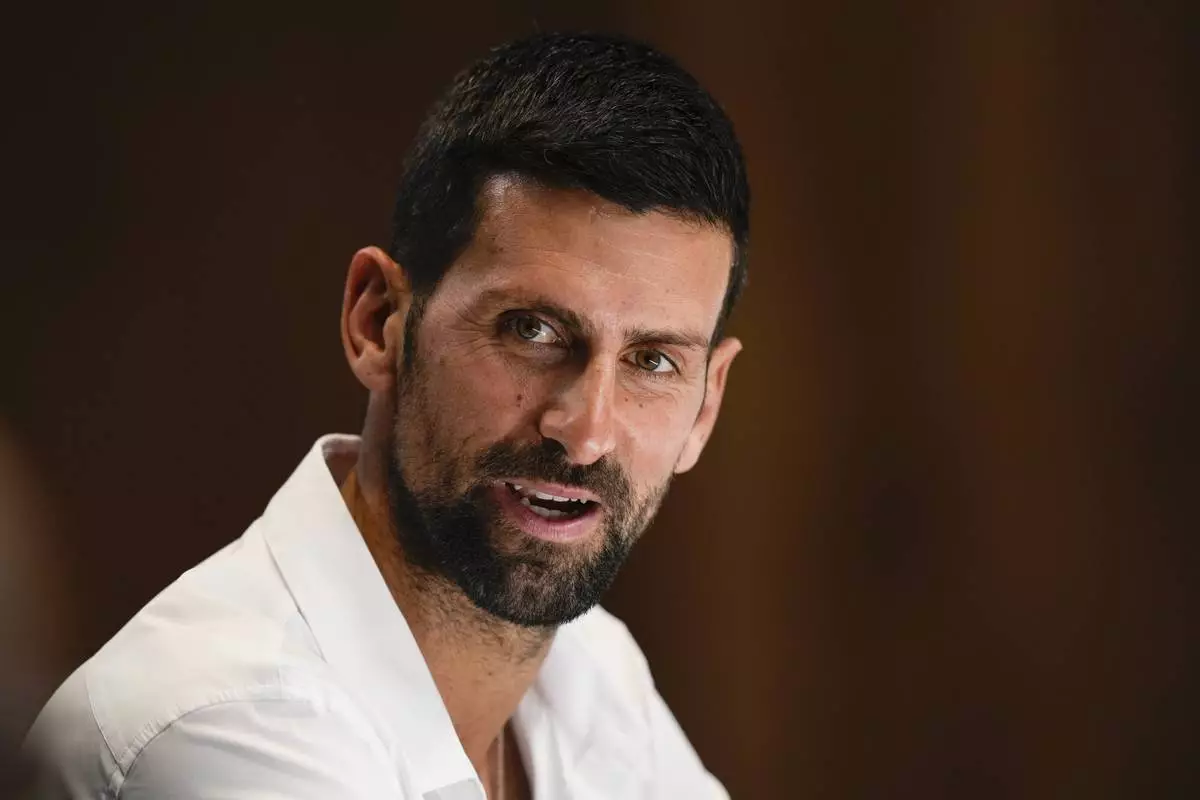

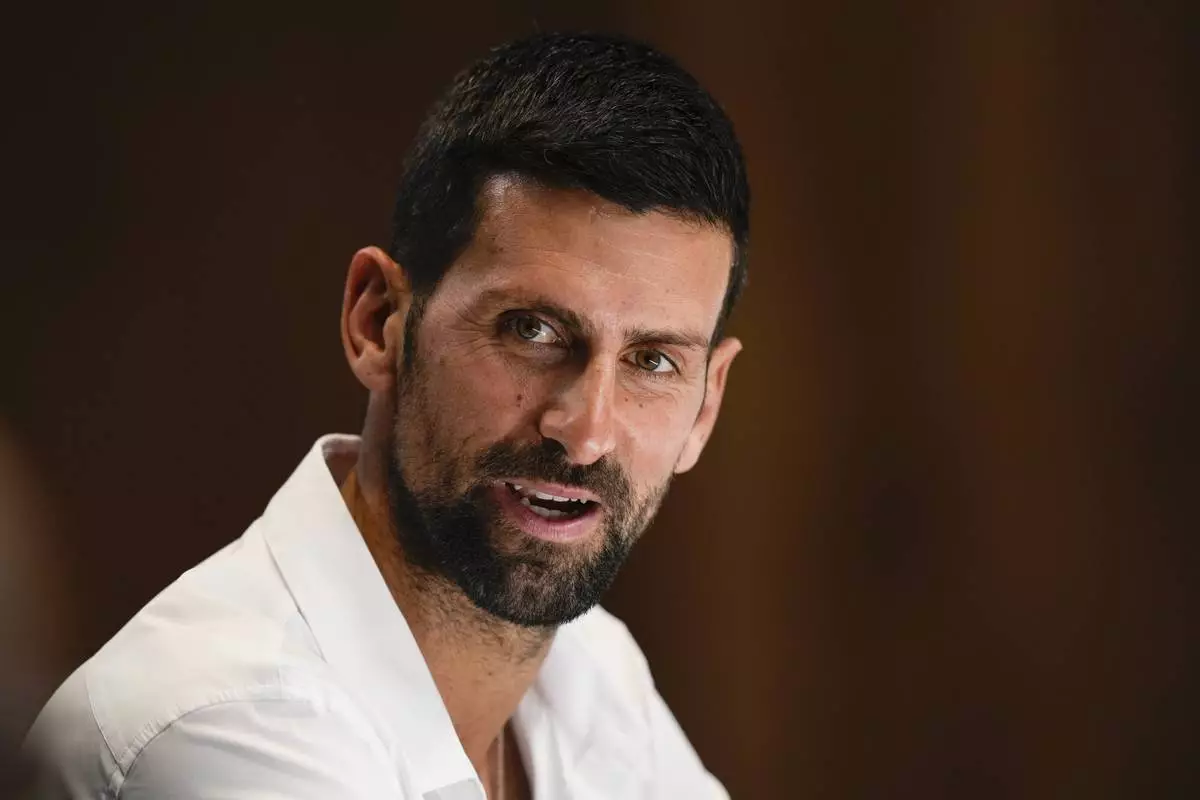

Serbia's Novak Djokovic reacts during a press conference ahead of the Australian Open tennis championship in Melbourne, Australia, Friday, Jan. 10, 2025. (AP Photo/Ng Han Guan)

BANGKOK (AP) — European shares opened higher on Friday and Asian stocks retreated after U.S. markets were closed to observe a National Day of Mourning for former President Jimmy Carter.

Germany's DAX was flat at 20,316.29, while the CAC 40 in Paris slipped 0.1% to 7,486.82. In London, the FTSE edged 0.1% lower, to 8,312.55.

The future for the S&P 500 was down 0.4% while that for the Dow Jones Industrial Average was 0.3% lower.

Markets in Asia saw a broad decline that analysts said reflects weakening confidence about the chances of further interest rate cuts by the Federal Reserve given recent data showing unexpected strength in the U.S. economy.

Minutes from a Dec. 17-18 meeting released this week showed Fed officials expected to dial back the pace of interest rate cuts this year in the face of persistently elevated inflation and the threat of widespread tariffs increases under President-elect Donald Trump and other potential policy changes.

“It appears that markets, at some level, are fretting (over) the risk that the Fed will keep policy a lot more restrictive than is conducive for sustaining unbridled ‘risk on,’” Tan Jing Yi of Mizuho Bank said in a commentary.

Uncertainties over how aggressively Trump might pursue higher tariffs against China and other countries once he takes office also have left investors cautious just days ahead of the Jan. 20 inauguration.

“Increased tariffs against Chinese goods are a given, but it is unclear which other economies in the region will be targeted and whether universal tariffs are still on the table,” ANZ Research said in a report.

Attention was focused on a U.S. non-farms jobs report due from the Labor Department later in the day.

In Tokyo, the Nikkei 225 index lost 1.1% to 39,190.40, while South Korea's Kospi shed 0.2% to 2,515.78.

Chinese markets extended losses, with the Hang Seng in Hong Kong down 0.9% at 19,064.29. The Shanghai Composite index fell 1.3%, to 3,168.52.

In Australia, the S&P/ASX 200 gave up 0.4% to 8,294.10.

Bangkok's SET rose 0.3%, while the Sensex in India dropped 0.3%. Taiwan's Taiex slipped 0.3% higher.

In the United States, the bond market remained open Thursday until its recommended closure at 2 p.m. Eastern time. Yields held relatively steady following a strong recent run that has rattled the stock market.

The yield on the 10-year Treasury was sitting at 4.69% after topping 4.70% the day before, when it neared its highest level since April. It was below 3.65% in September.

Higher yields hurt stocks by making it more expensive for companies and households to borrow and by pulling some investors toward bonds and away from stocks. Yields have been climbing as reports on the U.S. economy have come in better than economists expected. Worries about possible upward pressure on inflation from tariff, tax and other policies that Trump prefers have also pushed yields higher.

In other dealings early Friday, U.S. benchmark crude oil rose $1.12 to $75.04 per barrel. Brent crude, the international standard, rose $1.14 to $78.06 per barrel.

The U.S. dollar fell to 157.68 Japanese yen from 158.14 yen. The euro rose to $1.0303 from $1.0301.

People walk in front of an electronic stock board showing Japan's Nikkei index at a securities firm Thursday, Jan. 9, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)

People stand near an electronic stock board showing Japan's Nikkei index at a securities firm Thursday, Jan. 9, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)

A person walks in front of an electronic stock board showing Japan's Nikkei index at a securities firm Thursday, Jan. 9, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)

A person rides a bicycle in front of an electronic stock board showing Japan's Nikkei index at a securities firm Thursday, Jan. 9, 2025, in Tokyo. (AP Photo/Eugene Hoshiko)

FILE - The New York Stock Exchange is shown in New York's Financial District on Dec. 31, 2024. American flags flew at half-staff there following the death of former U.S. president Jimmy Carter. (AP Photo/Peter Morgan, File)