MOUNTAIN VIEW, Calif.--(BUSINESS WIRE)--Dec 19, 2024--

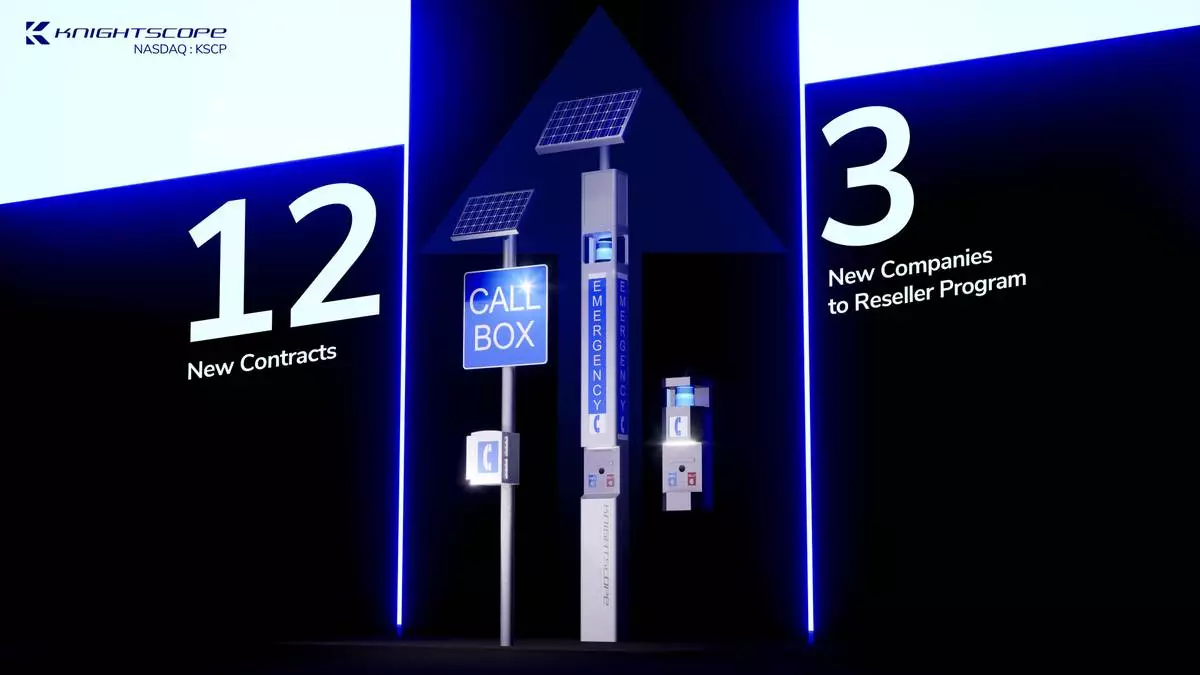

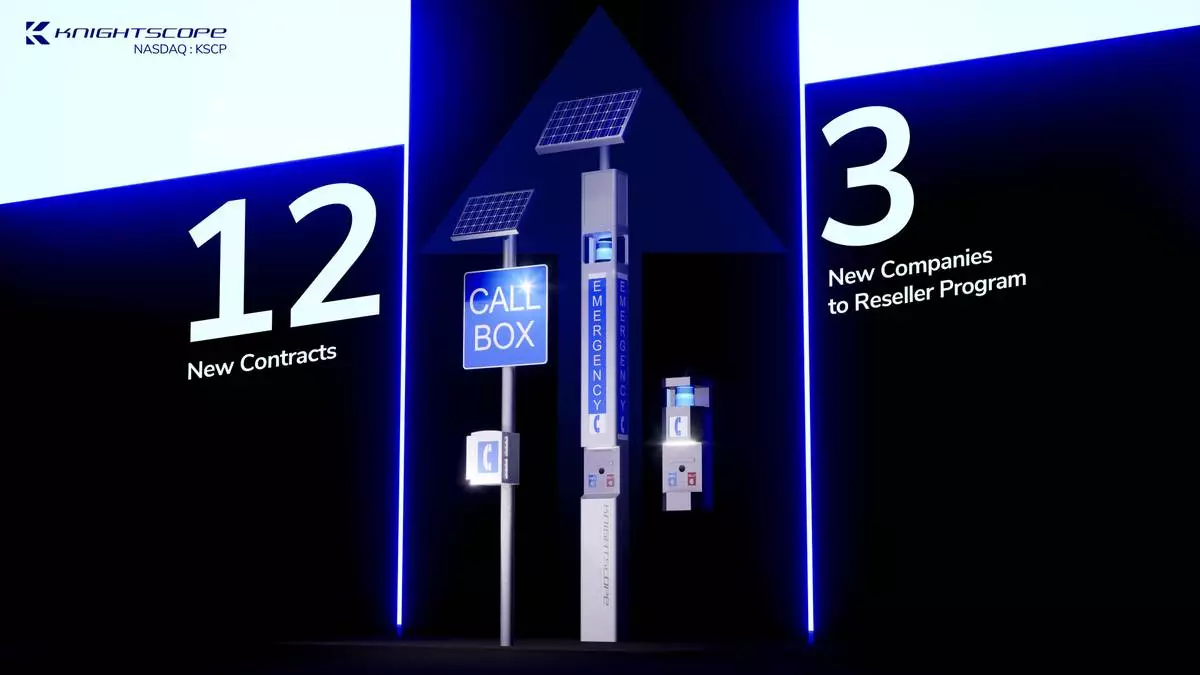

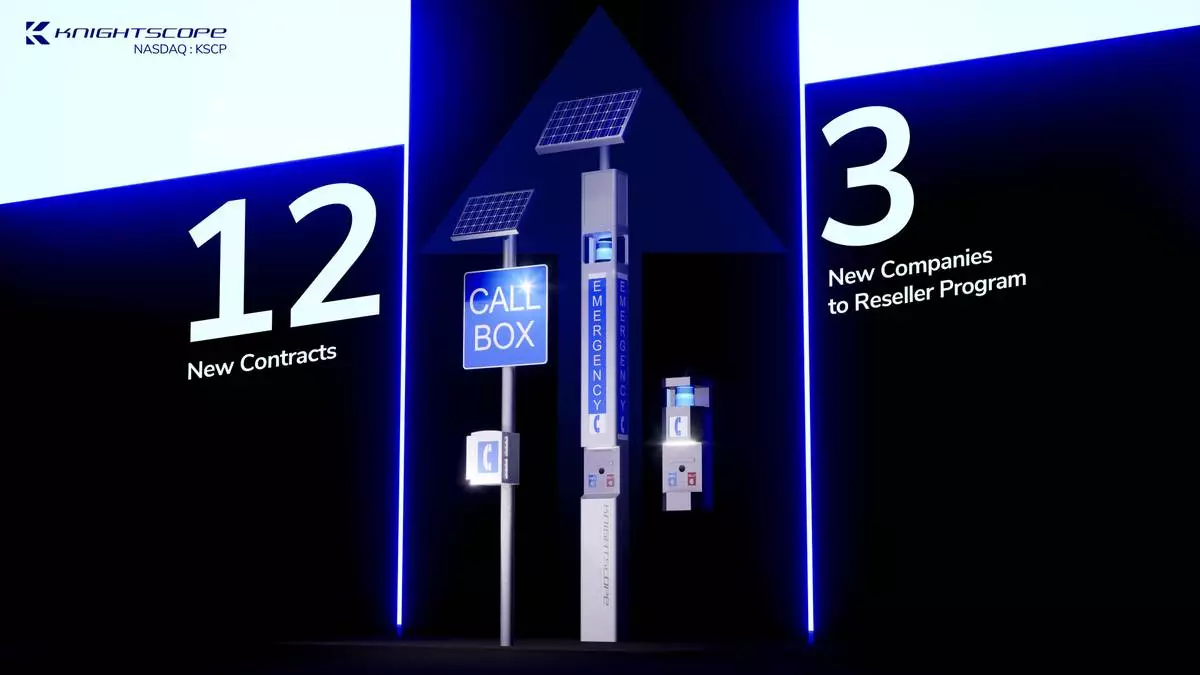

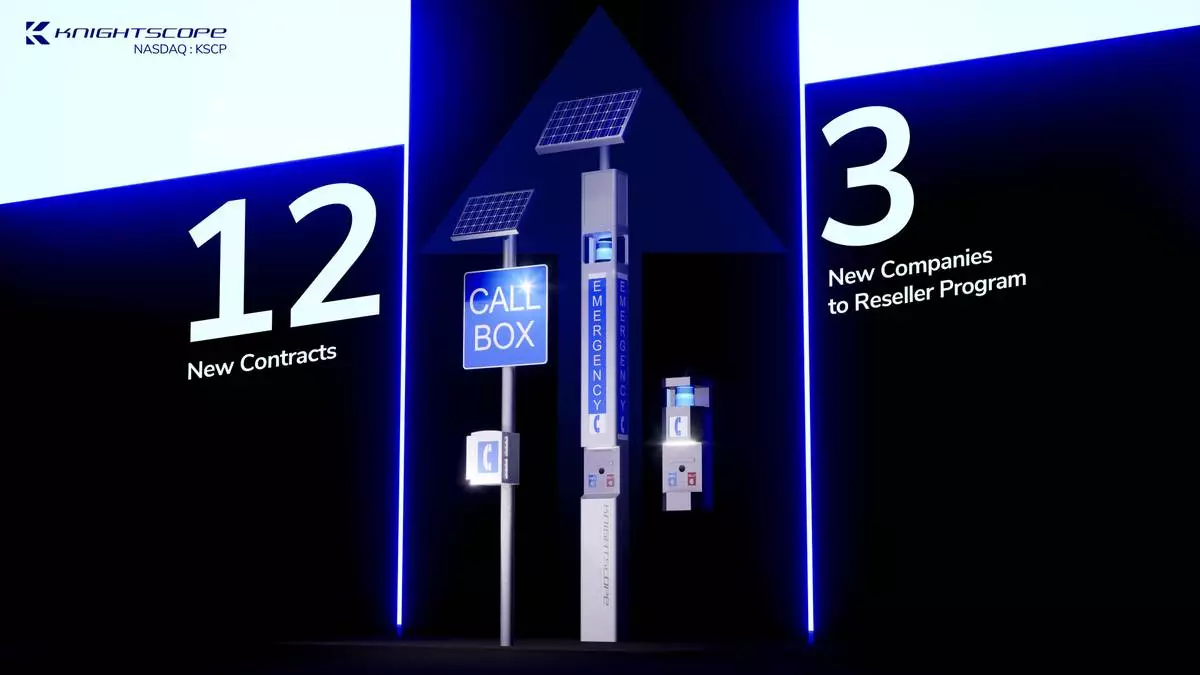

Knightscope, Inc. [Nasdaq: KSCP] (“Knightscope” or the “Company”), an innovator in robotics and artificial intelligence (“AI”) technologies focused on public safety, today announces that it has closed 12 new contracts in 7 U.S. states for its K1B Emergency Communication Devices (“ECDs”) and related services. Deployment locations will span the United States across Arizona, California, Connecticut, New Hampshire, New Jersey, New York, and Texas representing diverse industries such as state and local government, universities and transportation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241219101240/en/

The new sales are derived from both new clients as well as existing clients expanding their use of the Company’s technology and service offerings. Knightscope’s modern, blue light ECDs are the key to curing an overconfident dependence on cell phones. Many people may not have (or simply may not be carrying) a cell phone, the cell phone’s battery may be down, or there may be no signal in the area. Similarly, it is possible that visitors who find themselves in need of assistance may not be familiar with local geography and landmarks, thus being unable to give emergency responders an exact or accurate location over a cell phone. And with the recently announced service from Verizon Frontline, the advanced network and technology for first responders, users get priority access to cellular bandwidth to ensure the call reaches the right help in a timely manner.

The Company also added three new resellers to the Knightscope Authorized Partner (“KAP”) program - Clark Transportation Solutions in Phoenix, Arizona; Miller Solutions covering Arkansas and Oklahoma; and NEWCOM Global out of Boston, Massachusetts, with a nationwide client base. The KAP program provides access to Knightscope’s cutting-edge public safety solutions, including K1 Blue Light Towers and Blue Light E-Phones that feature voice connectivity, broadcast alerts, and area illumination capabilities, empowering them to offer the most technologically advanced emergency communication systems available. KAPs will be able to offer an expanded range of innovative tools to help clients improve safety at public facilities, reduce costs, and enhance the overall safety of their facilities.

GET EXPERT HELP

To learn more about Knightscope’s portfolio of public safety technologies, including any of its Autonomous Security Robots, Blue Light Emergency Communication Systems or Automated Gunshot Detection Services, book a discovery call or demonstration today at www.knightscope.com/discover.

About Knightscope

Knightscope builds cutting-edge technologies to improve public safety, and our long-term ambition is to make the United States of America the safest country in the world. Learn more about us at www.knightscope.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can be identified by the use of words such as “should,” “may,” “intends,” “anticipates,” “believes,” “estimates,” “projects,” “forecasts,” “expects,” “plans,” “proposes” and similar expressions. Forward-looking statements contained in this press release and other communications include, but are not limited to, statements about the Company’s goals, profitability, growth, prospects, reduction of expenses, and outlook. Although Knightscope believes that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks, uncertainties and other important factors that could cause actual results to differ materially from such forward-looking statements, including the factors discussed under the heading “Risk Factors” in Knightscope’s Annual Report on Form 10-K for the year ended December 31, 2023, as updated by its other filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date of the document in which they are contained, and Knightscope does not undertake any duty to update any forward-looking statements, except as may be required by law.

Growth in Knightscope Emergency Communications Continues with 12 New Contracts (Graphic: Business Wire)

NEW YORK (AP) — U.S. stocks are rising on Wall Street following one of their worst days of the year. The S&P 500 climbed 0.9% in early trading Thursday, a day after tumbling when the Federal Reserve said it may deliver fewer cuts to interest rates next year than earlier thought. The Dow Jones Industrial Average was up 383 points, or 1%. The Nasdaq composite rose 1%. The S&P 500 is still on track for one of its best years of the millennium. Darden Restaurants, which owns Olive Garden and other chains, rose after delivering profit that edged past analysts’ expectations.

THIS IS A BREAKING NEWS UPDATE. AP’s earlier story follows below.

Wall Street was heading toward a rebound Thursday following a big selloff one day earlier when the Federal Reserve forecast fewer interest rate cuts in 2025 that it previously projected.

Futures for the S&P 500 gained 0.7% while futures for the Dow Jones Industrial Average were up 0.5%.

Although the Fed on Wednesday announced it was cutting its key rate by a quarter of a percentage point as expected, investors were somewhat caught off guard by the central bank's projections for rate cuts next year. The median expectation among Fed officials is for two more cuts to the federal funds rate in 2025, or half a percentage point’s worth. That’s down from the four cuts — equal to at least a full percentage point — expected just three months ago.

Wall Street loves lower interest rates, but the cut was already widely expected and investors were more focused on how much more the Fed will cut next year. Expectations for a series of cuts in 2025 helped the U.S. stock market set an all-time high 57 times so far in 2024.

On Wednesday, the S&P 500 fell 3%, just shy of its biggest loss for the year. The Dow lost 1,123 points, or 2.6%, and the Nasdaq composite dropped 3.6%. The Russell 2000 index of small-cap stocks tumbled 4.4%.

Powell said some Fed officials, but not all, are also already trying to incorporate uncertainties inherent in a new administration coming into the White House. Worries are rising on Wall Street that President-elect Donald Trump’s preference for tariffs and other policies could further fuel inflation.

“When the path is uncertain, you go a little slower,” Powell said.

Wednesday’s cut — which brought the Fed's benchmark rate down to between 4.25% and 4.5% — was its third this year.

In U.S. premarket trading Thursday, Micron tumbled 12.1% after the Idaho-based chipmaker beat Wall Street profit targets but gave a tepid forecast for early next year. Another Idaho company, Lamb Weston, tumbled nearly 20% before the bell. The maker of french fries and other frozen potato products badly missed analysts' profit targets and fell short on sales too.

Darden Restaurants, the owner of Olive Garden and other casual dining chains, climbed 9.3% after it gave a strong 2025 sales forecast.

Amazon shares were up 1.4% early, even as workers at seven of its facilities were set to strike early Thursday, right in the middle of the online retail giant's busiest time of the year. Amazon says it doesn’t expect an impact on its operations during what the workers' union calls the largest strike against the company in U.S. history.

In Europe, the Bank of England kept its main interest rate unchanged at 4.75% Thursday, with new data showing inflation rising to 2.6%. The rate pause comes as inflation there moved further above the central bank's 2% target rate, while the British economy is flatlining at best.

In midday European trading, Britain’s FTSE 100 lost 1.2%, as did the CAC 40 in Paris. Germany’s DAX was 0.9% lower.

The Bank of Japan opted to keep its benchmark rate at 0.25%. That decision, which also was no surprise, pushed the dollar higher against the Japanese yen.

The dollar was trading at 156.88 yen, up rom 154.79 yen late Wednesday.

In Asia, Tokyo’s Nikkei 225 lost 0.7% to 38,813.58.

Chinese markets also declined. The Hang Seng index fell 0.6% to 19,752.51, while the Shanghai Composite index dropped 0.4% to 3,370.03.

Australia's S&P/ASX 200 shed 1.7% to 8,168.20, while the Kospi in South Korea slipped 2% to 2,435.93. India's Sensex fell 1.2%.

In Taiwan, the Taiex lost 1%, while Bangkok's SET fell 1.5%.

In other dealings early Thursday, U.S. benchmark crude oil gave up 23 cents to $69.79 per barrel in electronic trading on the New York Mercantile Exchange. Brent crude, the international standard, fell 26 cents to $73.13 per barrel.

The euro rose to $1.0405 from $1.0355.

Specialist Anthony Matesic works on the floor of the New York Stock Exchange as the rate decision of the Federal Reserve is announced, Wednesday, Dec. 18, 2024. (AP Photo/Richard Drew)

People walk on Wall Street in New York's Financial District on Wednesday, Dec. 18, 2024. (AP Photo/Peter Morgan, File)

A board above the floor of the New York Stock Exchange shows the closing number for the Dow Jones industrial average, Wednesday, Dec. 18, 2024. (AP Photo/Richard Drew)

TV cameraman films near the screens showing the Korea Composite Stock Price Index (KOSPI), left, the foreign exchange rate between U.S. dollar and South Korean won, center, and South Korean won and the Korean Securities Dealers Automated Quotations (KOSDAQ) at a foreign exchange dealing room in Seoul, South Korea, Thursday, Dec. 19, 2024. (AP Photo/Lee Jin-man)

A currency trader walks by the screens showing the Korea Composite Stock Price Index (KOSPI), left, and the foreign exchange rate between U.S. dollar and South Korean won at a foreign exchange dealing room in Seoul, South Korea, Thursday, Dec. 19, 2024. (AP Photo/Lee Jin-man)