STORRS, Conn. (AP) — Geno Auriemma became the winningest coach in NCAA college basketball history, earning his 1,217th victory as No. 2 UConn beat Fairleigh Dickinson 85-41 on Wednesday night.

Auriemma broke a tie with retired Stanford coach Tara VanDerveer for the most victories all-time. Former Duke coach Mike Krzyzewski holds the men's record with 1,202. Auriemma began his journey with UConn in 1985 and is 1,217-162 in his career. He has only had one losing season — his first one with the Huskies.

The Huskies (4-0) celebrated Auriemma and associated head coach Chris Dailey's 40 years at the school with more than 60 alums, including former UConn greats Sue Bird, Diana Taurasi, Maya Moore and Rebecca Lobo in attendance.

UConn's latest star led the way as Paige Bueckers had 16 points, nine rebounds and five assists. Freshman Sarah Strong had 20 points.

FDU (4-2) hung around for the first few minutes and only trailed 14-12 before UConn scored nine of the final 11 points of the quarter. The Knights didn't get within single digits the rest of the way.

FDU: The Knights won their first four games this season — the first time that happened in 33 years.

UConn: The Huskies are finally starting to get healthy which will give Auriemma a deeper bench as the season progresses.

Azzi Fudd made her return to the UConn lineup after missing the last year with a right knee injury. She checked in with 3:39 left in the first quarter. She received a loud ovation from the crowd when she came into the game.

FDU coach Stephanie Gaitley is 24th on the NCAA wins list and is two victories short of 700.

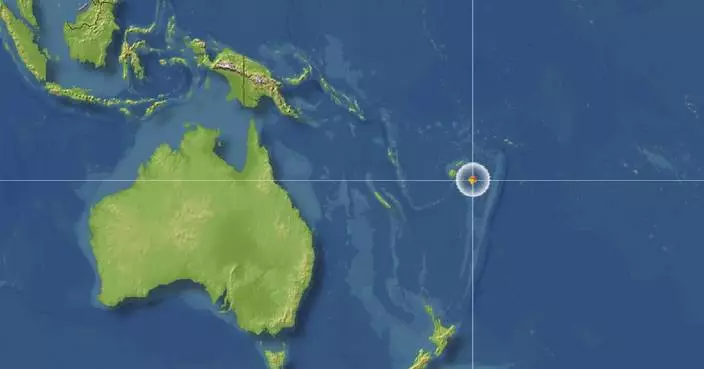

FDU hosts Saint Peter's on Saturday while UConn heads to the Bahamas to play in a tournament. The Huskies' first game is against Oregon State on Monday.

Get poll alerts and updates on the AP Top 25 throughout the season. Sign up here. AP women’s college basketball: https://apnews.com/hub/ap-top-25-womens-college-basketball-poll and https://apnews.com/hub/womens-college-basketball

Former UConn players Sue Bird, left, and Diana Taurasi, share a laugh during a pregame ceremony honoring Geno Auriemma and longtime assistant Chris Dailey, Wednesday, Nov. 20, 2024, in Storrs, Conn. (AP Photo/Jessica Hill)

DEIR AL-BALAH, Gaza Strip (AP) — Israeli strikes on the Gaza Strip killed at least 14 Palestinians, mostly women and children, and destroyed bulldozers and other heavy equipment that had been supplied by mediators to clear rubble. A separate strike in Lebanon on Tuesday killed a member of a local Islamist group.

Israel's 18-month offensive against Hamas has destroyed vast areas of Gaza, raising fears that much of it may never be rebuilt. The territory already had a shortage of heavy equipment, which is also needed to rescue people from the rubble after Israeli strikes and to clear vital roads.

A municipality in the Jabaliya area of northern Gaza said a strike on its parking garage destroyed nine bulldozers provided by Egypt and Qatar, which helped broker the ceasefire that took hold in January. Israel ended the truce last month, renewing its bombardment and ground operations and sealing the territory's 2 million Palestinians off from all imports, including food, fuel and medical supplies.

The strikes also destroyed a water tanker and a mobile generator provided by aid groups, and a truck used to pump sewage, the Jabaliya al-Nazla municipality said.

There was no immediate comment from the Israeli military on the strikes. The military says it only targets militants and blames civilian deaths on Hamas because the group operates in densely populated areas.

An Israeli airstrike early Tuesday destroyed a multistory home in the southern city of Khan Younis, killing nine people, including four women and four children, according to Nasser Hospital, which received the bodies. The dead included a 2-year-old girl and her parents.

“They were asleep, sleeping in God’s peace. They had nothing to do with anything,” said Awad Dahliz, the slain girl's grandfather. “What is the fault of this innocent child?"

A separate strike in the built-up Jabaliya refugee camp killed three children and their parents, according to the Gaza Health Ministry's emergency service.

Israel's air and ground war has killed over 51,000 Palestinians, mostly women and children, according to the ministry, which does not say how many of the dead were civilians or combatants. Israel says it has killed around 20,000 militants, without providing evidence.

The war began when Hamas-led militants attacked southern Israel on Oct. 7, 2023, killing some 1,200 people, mostly civilians, and taking 251 people hostage. They are still holding 59 hostages, 24 of whom are believed to be alive, after most of the rest were released in ceasefire agreements or other deals.

Hamas has said it will only free the remaining hostages in return for the release of Palestinian prisoners, a full Israeli withdrawal and a lasting ceasefire. Israel has said it will keep fighting until the hostages are returned and Hamas has been either destroyed or disarmed and sent into exile. It has pledged to hold onto so-called security zones in Gaza indefinitely.

An Israeli drone strike southeast of Beirut killed Hussein Atwi, a member of the Lebanese branch of the Muslim Brotherhood, a regionwide Sunni Islamist political movement. The group said he was leaving for work when the drone struck.

Israel has continued to carry out regular strikes across Lebanon despite reaching a ceasefire with the Hezbollah militant group in November. Israel says it is targeting militants and weapons caches. The Lebanese government says 190 people have been killed and 485 wounded since the ceasefire took hold.

Hezbollah began firing on Israel the day after Hamas' Oct. 7 attack. Israel responded with airstrikes, and the conflict in Lebanon escalated into a full-blown war in September when Israel carried out a heavy wave of strikes and killed most of Hezbollah's top leadership.

Magdy reported from Cairo. Associated Press writer Sally Abou AlJoud in Beirut contributed.

Follow AP’s war coverage at https://apnews.com/hub/israel-hamas-war

Palestinians inspect the damage caused by an Israeli army airstrike in Khan Younis, Gaza Strip, Tuesday, April 22, 2025. (AP Photo/Abdel Kareem Hana)

Palestinians inspect the damage caused by an Israeli army airstrike in Khan Younis, Gaza Strip, Tuesday, April 22, 2025. (AP Photo/Abdel Kareem Hana)

Palestinians inspect the damage caused by an Israeli army airstrike in Khan Younis, Gaza Strip, Tuesday, April 22, 2025. (AP Photo/Abdel Kareem Hana)

Palestinians inspect the damage caused by an Israeli army airstrike in Khan Younis, Gaza Strip, Tuesday, April 22, 2025. (AP Photo/Abdel Kareem Hana)

Palestinians examine the remains of bulldozers hit by an Israeli army airstrike in Jabaliya, northern Gaza Strip, on Tuesday, April 22, 2025. (AP Photo/Jehad Alshrafi)

Palestinians examine the remains of bulldozers hit by an Israeli army airstrike in Jabaliya, northern Gaza Strip, on Tuesday, April 22, 2025. (AP Photo/Jehad Alshrafi)

Smoke rises from the remains of bulldozers hit by an Israeli army airstrike in Jabaliya, northern Gaza Strip, on Tuesday, April 22, 2025. (AP Photo/Jehad Alshrafi)

A Palestinian man extinguishes the fire from bulldozers after they were hit by an Israeli army airstrike in Jabaliya, northern Gaza Strip, on Tuesday, April 22, 2025. (AP Photo/Jehad Alshrafi)

Palestinians examine the remains of bulldozers hit by an Israeli army airstrike in Jabaliya, northern Gaza Strip, on Tuesday, April 22, 2025. (AP Photo/Jehad Alshrafi)

Palestinians examine the remains of bulldozers hit by an Israeli army airstrike in Jabaliya, northern Gaza Strip, on Tuesday, April 22, 2025. (AP Photo/Jehad Alshrafi)